Introduction

Managing the books of a company today is a rather big undertaking. It consumes an entire day, and no one wants to get into accounting or be saddled with such work. What’s more vital is managing the business and ensuring it grows. A credible tax and bookkeeping service will help you get organized, keep in line, and free up for other activities. However, what are the requirements that make an efficient and reliable tax and bookkeeping service?

Whatever your status is, whether it is a business owner, entrepreneur, or professional responsible for the decisions on what to look for in such a service is sure to save you headaches shortly. Let’s cover the most important attributes defining a reliable tax and bookkeeping service.

Expertise and Qualifications

Any good tax and bookkeeping service is in the qualifications and expertise of its team. You would want a provider who is aware of what currently governs tax law and accounting standards and the trends in their field. Look for these details:

- Certified Professionals: The team should be comprised of certified accountants (CPAs) and experienced bookkeepers.

- Industry Niche: Most industries have differences in tax requirements. A knowledgeable service provider in your industry could offer insights that the generalist may miss.

- Tax Law Updates: Tax laws can change overnight. An excellent service should keep up with all the changes so that your business stays out of trouble.

With a good team, you prevent errors that may result in penalties and lost savings in taxes.

Accuracy and Attention to Detail

Bookkeeping is no room for mistakes. Little mistakes can add up to serious results, including wrongly paid taxes, wrongly taken business decisions, and the like. When asking for a reliable tax and bookkeeping service, you have every right to ask them how they guarantee accuracy:

- Verification systems: Do they have a system of entry verification in place? An internal review mechanism helps avoid mistakes.

- Automated Software Tools: They may or may not automate bookkeeping procedures to minimize the possibility of human error. Still, the final product must be taken by qualified professionals.

- Track Record: Ask them for references or case studies showing their track record of no errors or mistakes in bookkeeping.

An error-free bookkeeping system brings peace of mind because you will be confident that the financial records are accurate and do not run afoul of regulations.

Also Read: 6 Reasons to Hire Virtual Personal Assistant

Technology and Automation

A reliable tax and bookkeeping service, in the contemporary digital world, needs to seize each opportunity to simplify the process with technology that streamlines the activity. Conventional bookkeeping will be cumbersome and full of errors, but proper utilization of the best tool will give a sense of proficiency and accuracy.

- Cloud-Based Accounting Software: Services like cloud-based solutions would be QuickBooks, Xero, or FreshBooks. These services provide you with real-time access to your financials from any location.

- Integrates Other Business Tools: A good accounting service must integrate well with payroll systems, invoicing platforms, and even other similar financial management tools.

- Automation of Repetitive Tasks: Auto-filling the data entry or processing invoices cuts down on errors and increases efficiency.

Therefore, bookkeeping is enhanced by technology and ensures that not just accuracy, but also efficiency is maintained.

Tax Compliance and Audit Support

As a general rule, most businesses retain the services of a tax and bookkeeping service to maintain tax compliance.

A good and reliable tax and bookkeeping service should be able to provide you with:

- Timely Filing of Tax Returns: Lateness in the filing of tax returns usually results in many fines and penalties. A good service will look to it that all your returns are filed on time.

- Having a grasp of deductions and credits: This seasoned tax professional knows the right ways to maximize your deductions and credits while keeping you compliant.

- Audit support: You will need a team that will represent your business in case of an audit, and then provide actual documentation. Audit assistance should be offered as part of their package.

The right service will keep your business in good standing with tax authorities and protect you from unnecessary penalties or legal issues.

Customized Services

Every business is different, so their bookkeeping requirements are also remarkable. A reliable tax and bookkeeping service offers extraordinary options for your particular business.

- Customized Packages: Can they develop a service package to fit your business size, industry, and special financial needs?

- Scalability: As your business grows, can the services grow alongside you, providing more advanced bookkeeping and tax planning solutions?

- Special Requests: Do they handle special requests, such as handling several accounts or managing payroll in addition to bookkeeping?

Customized services enable you to get only what you specifically require, while not necessarily paying for the extras you may not want.

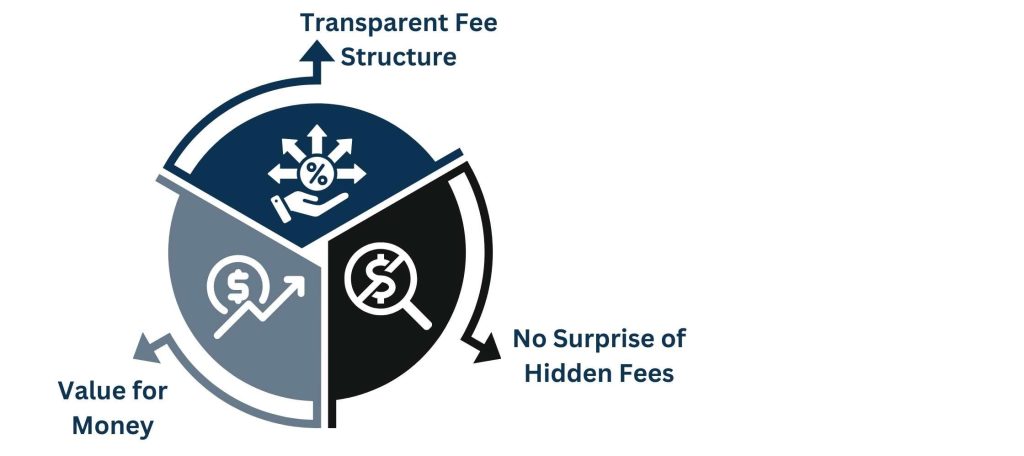

Transparent Pricing

Who doesn’t hate the darkness of unknown fee payment? A reliable tax and bookkeeping service ensures there’s always never a dark, misplaced fee. So, transparency in pricing matters in such a service.

- Transparent Fee Structure: Seek services with a transparent fee structure that has no hidden fees.

- Value for Money: What is cheap and what isn’t. The cheap isn’t always the best option, but there are also value and quality services in options.

- No Surprise of Hidden Fees: No way you want to be surprised by fees or charges. Ensure they break down everything included in the pricing plan before any agreements.

A good service with price clarity always gives a thumbs-up because it doesn’t blind you to hidden and additional things.

Consistent and Clear Communication

A good tax and bookkeeping service will maintain an open channel of communication. You should feel comfortable knowing that your service provider will be there when you need answers or are concerned about a particular issue.

- One Dedicated Account Manager: It is helpful to have only one contact who understands your business and can provide individualized attention.

- Timely Responses: It could be an answer to an overnight query about a specific transaction and relevant information about your financial health. Timely responses are certainly very important.

- Regular Updates: Constant updates about your reports and regular communications are always pertinent in keeping you abreast of your financial setup.

Effective communication creates an even better working relationship and ensures your financial management is well on track.

Proven Track Record and Positive Reviews

Lastly, check the reputation of a reliable tax and bookkeeping service before finalizing your choice.

- Client Testimonials and Case Studies: Check reviews or case studies coming from businesses like yours. How is their experience? Were they satisfied with the service?

- Years in Business: A long history would be a good indication of reliability. It is a given that a company that has long been in business for years has already established its track record.

- Accolades and Other Recognition: Relevant industry accreditations and awards will strengthen the authenticity of the service provider.

Ensure your finances are in good hands with a proven history of success in a company you are dealing with.

Conclusion

Choosing a reliable tax and bookkeeping service for your business is a crucial decision that may make or break the health of your financials. You are looking for expertise, accuracy, cutting-edge technology, compliance support, customization options, transparent pricing, excellent communication, and, above all, an excellent track record. Keeping all these factors in mind will get you a partner that you can depend on to handle bookkeeping and tax concerns so that you can focus on business growth.

Tasks Expert is a virtual assistant group. This can be as broad as thorough bookkeeping and tax service and may include an entire team to help keep you properly organized and compliant to save you time and stress.

About Us

Tasks Expert offers top-tier virtual assistant services from highly skilled professionals based in India. Our VAs handle a wide range of tasks, from part time personal assistant to specialized services like remote it support services, professional bookkeeping service etc. Furthermore, it helps businesses worldwide streamline operations and boost productivity.

Ready to elevate your business? Book a Call and let Tasks Expert take care of the rest.