Introduction

Payroll management forms one of the most critical aspects of operating any business, but it could be quite tricky, time-consuming, and erroneous if not approached correctly. Comprehensive payroll processing covers all the processing needs to guarantee accurate, compliant, and timely payment to employees.

This blog discusses all the advantages, parts, and tools engaged in payroll processing that are usually fully completed to ensure that businesses run effectively.

What is Complete Payroll Processing?

Complete payroll processing is the end-to-end management of employee compensation that keeps track of salary computation, tax deduction, benefits, and compliance reporting. It requires using systems and strategies aimed at making payroll management smooth and free of errors.

Main Components of Payroll Processing:

- Gross and net pay computation.

- Tax deduction and others.

- Distributing paychecks or conducting direct deposits.

- Preparation of tax reports with due compliance.

- Management of employees’ benefits and claims.

Advantages of Complete Payroll Processing

- Time and cost savings: Automate routine tasks to free up resources and focus on core business functions.

- Accuracy and Compliance: Minimize errors in calculations and ensure compliance with tax laws and regulations.

- Improved Employee Satisfaction: Ensure timely and accurate payments, which increases morale and trust.

- Scalability: Payroll for growing teams and changing business needs is handled effortlessly.

- Data Security: Sensitive employee information is protected through secure systems and processes.

- Detailed Reporting: Comprehensive reports are generated for audits, management, and tax purposes.

How to Process an Entire Payroll Cycle?

- Collecting All Employee Information: Collect all work hours, benefits information, and tax information

- Compute Gross Pay: Compute total compensation, including overtime, bonuses, commissions, etc.

- Federal, State, and Local Taxes, Other Withholdings: Exclude federal, state, and local taxes, social security, medicare, and other withholdings.

- Benefits and Expense Reimbursement: Health, pension, expense pay, and many other benefits.

- Payments: Make payroll payments via direct deposit, paper cheque, payroll card, and other methods.

- Reporting Compliance: File tax documents and maintain records per law.

Tools for Payroll Processing

- Payroll Software: Gusto, ADP, Paychex.

- Time Tracking Tools: TSheets, Clockify, TimeCamp.

- Tax Management Tools: QuickBooks, Xero, Wagepoint.

- Employee Self-Service Portals: Zenefits, BambooHR, Workday.

- Compliance Tracking: TaxJar, Avalara, ComplyRight.

Challenges in Payroll Processing and solutions to Overcome Them

1. Regulations:

Solution: Utilize payroll software that keeps up-to-date with the changing tax laws.

2. Mathematical Errors:

Solution: Automate calculations to reduce mathematical errors.

3. Late Payments:

Solution: Reminders or recurring payment schedules.

4. Data Security Risks:

Solution: Secure systems with encryption and restricted access.

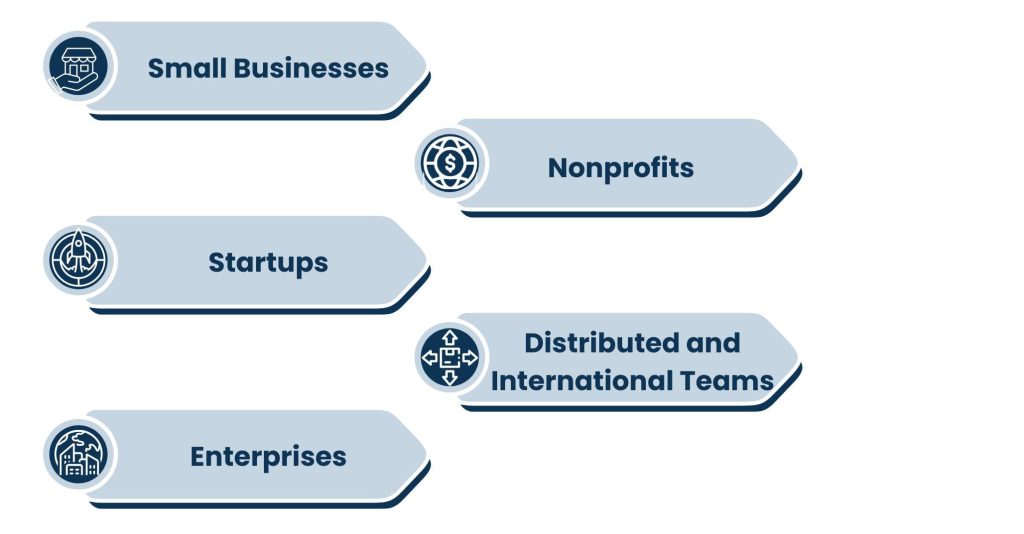

Who Can Benefit from Complete Payroll Processing?

- Small Businesses: Streamline payroll tasks without a dedicated HR department.

- Startups: Handle growing teams efficiently with scalable payroll solutions.

- Enterprises: Manage large-scale payroll operations with advanced reporting and compliance tools.

- Nonprofits: Ensure compliance with grant-related payroll regulations.

- Distributed and International Teams: Streamline multiple currencies and border taxes.

Conclusion

Completing payroll processing is one of the essential solutions businesses need for streamlined employee payments. Payroll processing assists in automating tasks, ensures compliance, and safeguards sensitive data for smooth operations and increased employee satisfaction.

Whether working with a small team or a large workforce, investing in complete payroll processing can save time and minimize errors, thus making your business run smoothly. Start optimizing your payroll process today!

About Us

Tasks Expert offers top-tier virtual assistant services from highly skilled professionals based in India. Our VAs handle a wide range of tasks, from part time personal assistant to specialized services like remote it support services, professional bookkeeping service etc. Furthermore, it helps businesses worldwide streamline operations and boost productivity.

Ready to elevate your business? Book a Call and let Tasks Expert take care of the rest.