Introduction

From moving from spreadsheets or replacing a busy internal process, a clean start decides how smoothly Remote cost accounting will run. The goal is simple. Collect the right inputs once, set clear routines, and produce reliable cost visibility every month.

This guide keeps onboarding calm and predictable. You get a short list of items to prepare, a clear week one plan, and a steady rhythm for weeks two to four. The work maps your cost drivers, connects bank feeds, and locks a chart of accounts that matches how your business operates in real life.

Use this as the exact checklist for your team. You will see what to send before kickoff, what happens in the first week, how the engine stabilizes, and what reports land on your desk. Share it with finance, operations, and owners so everyone knows what is coming next and who does what.

Remote cost accounting essentials to prepare

A strong start needs a few accurate inputs. Gather these items before the kickoff call to move fast without going back and forth.

Financial access and tools:

Provide viewer or accountant access to your accounting system, like QuickBooks, Xero, or Zoho Books. Share read-only bank and card statements or connect secure feeds. This enables timely reconciliations without waiting for files.

Entity details and policies:

Send incorporation docs, tax IDs, and current fiscal year settings. Share expense policies, approval limits, and reimbursement rules. Clear guardrails keep coding consistent from day one.

Chart of accounts and dimensions:

Share your chart of accounts, cost centers, and any custom tagging, like projects or locations. Map what to keep, what to merge, and what to add so reporting reflects how you manage the business.

Historical data and open items:

Provide the last twelve months of trial balances, aged payables, and open purchase orders. Use this to spot gaps, clean duplicates, and carry forward only valid balances.

Vendors and contracts:

Export the vendor list with payment terms and primary contacts. Attach major contracts and subscriptions. This helps verify rates, catch auto-renewals, and schedule reviews.

Payroll and people costs:

Share payroll summaries, benefits plans, and allocation rules for departments or projects. People often drive the model, so set them correctly at the start.

Security and permissions:

Use a password manager and two-factor authentication. Limit roles to the least privilege and log all access. A tight setup protects data while keeping work efficient.

Send these items once, and you avoid weeks of delays. With inputs in place, you can kick off and start producing usable cost views in the first cycle.

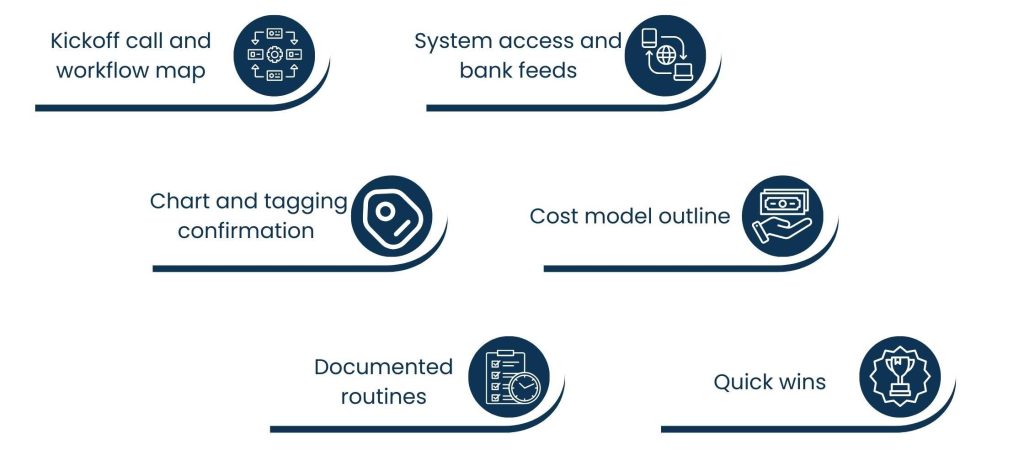

Week one, Remote cost accounting kickoff

Week one is about access, confirmation, and quick wins. Keep meetings short and decisions clear so momentum stays high.

Kickoff call and workflow map:

Confirm business goals, reporting cadence, and approval paths. Introduce the people who will handle the books. Agree on who signs off on decisions so there is no confusion later.

System access and bank feeds:

Validate logins, connect read-only feeds, and test a sample reconciliation. If feeds are not available, set a weekly statement drop into a secure folder. The goal is a clean, repeatable data pull.

Chart and tagging confirmation:

Walk through the chart of accounts and cost tags. Mark inactive codes, merge duplicates, and add missing categories together. This prevents messy recording later.

Cost model outline:

List the top five cost drivers, such as payroll, software, logistics, contractors, and marketing. Give each driver a simple rule for allocation and review. Useful reports begin in month one when the rules are clear.

Documented routines:

Write a one-page runbook for file delivery, cutoffs, and sign-off steps. Everyone can see the process and deadlines at a glance. Less guessing means faster work.

Quick wins:

Close small gaps like missing W-9 or vendor details, unpaid credits, or duplicate subscriptions. These easy wins build confidence and save money early.

By the end of week one, access is verified, the chart is tidy, and the routine is documented. You know exactly what happens next and when to expect draft reports.

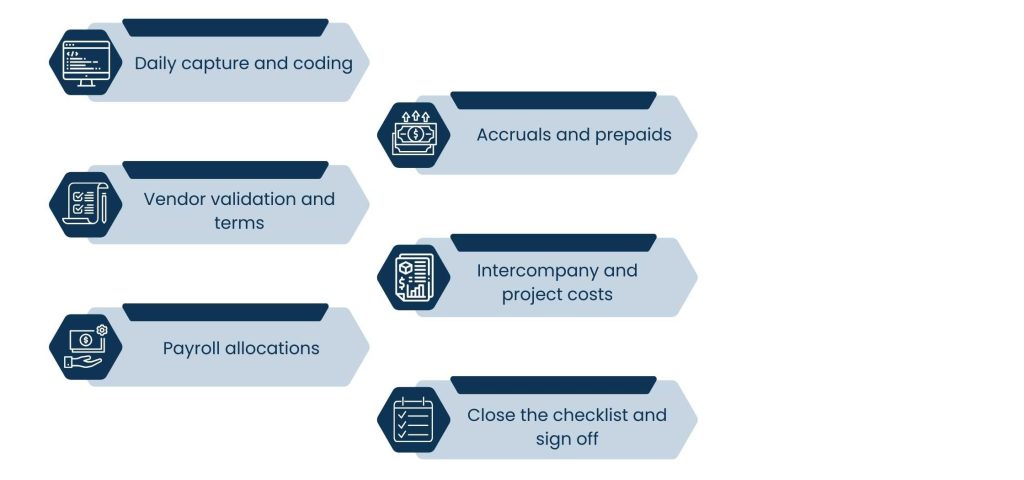

Weeks two to four stabilize the Remote cost accounting engine

With the foundation set, move into steady production. These steps create reliable monthly closes without drama.

- Daily capture and coding: Code new transactions daily and flag exceptions. Add clear notes on each entry so later reviews are painless. Progress is visible in a shared activity log.

- Vendor validation and terms: Confirm active vendors and check payment terms. Flag early payment discounts and duplicate charges. Record subscription renewal dates and owners.

- Payroll allocations: Apply agreed rules to split salaries and benefits across departments or projects. Log changes with dates and approver names. This keeps trend lines meaningful.

- Accruals and prepaids: Set rules for accruals and amortization of prepaids, such as insurance or annual software. Smooth costs over the right periods to improve comparability.

- Intercompany and project costs: When needed, create light rules for cross-billing and project tracking. Keep documentation for transfers so audit and tax reviews stay simple.

- Close the checklist and sign off: Run a close checklist that covers reconciliations, variance checks, and review notes. Send a short summary and action items. Nothing closes without a clear sign-off.

By the end of week four, the engine is stable. Coding is clean, cutoffs are predictable, and the close does not pull teams away from operations.

Cost drivers and allocation rules for Remote cost accounting

A clear view of costs starts with the big drivers and the rules that place each amount in the right bucket. Keep rules simple, write them down, and review them on a steady cadence.

Clear rules for reliable remote cost accounting:

- Payroll and benefits: Map every role to a department or project. Use a percent split only when work is truly shared. Lock the rule and record the approver so allocations stay consistent.

- Software and SaaS: Tag each license by team and environment, such as production or internal. Track seats against active users to cut waste. Note annual terms so prepaids amortize smoothly.

- Logistics and fulfillment: Tie shipping, warehousing, and packaging to product lines or regions. Use per order or per kilo rules for fair comparisons, month to month. Flag surcharges separately for visibility. Go through the eCommerce VA services for smooth operations.

- Contractors and agencies: Assign statements of work to projects with a start and end date. Add a milestone or hours cap to prevent overruns. Capture deliverables in the memo for clean audits.

- Marketing and demand: Split spend by channel, such as search, social, and events. Add lead source or campaign tags to connect costs with results. Park brand-level spend in a shared cost center.

- Facilities and utilities: Use headcount or square footage to apportion rent, power, and internet. Recheck the base each quarter as teams move. Keep one rule across sites to avoid confusion.

- Fixed versus variable: Mark costs as fixed or variable so unit economics make sense. Leaders can see what scales with volume and what does not. Review labels during quarterly planning.

- Review cadence and approvals: Run a short monthly review to test the rules on samples. Changes need a simple one-line why and a date to take effect. Archive old rules instead of overwriting.

Small, well-written rules make reports stable and decisions faster. That is the heart of Remote cost accounting that leaders can trust.

Vendor and subscription onboarding for Remote cost accounting

Clean vendor data prevents payment errors and surprise renewals. Onboarding sets the tone for accuracy, compliance, and savings.

- Master vendor list: Collect legal name, tax ID, payment method, and remit details. Merge duplicates and inactivate stale records. Require real contact so questions get answers.

- Contracts and terms: Store start date, end date, notice period, and pricing units. Note volume tiers and service credits. Link the file so reviewers can verify details in one click.

- Subscription inventory: List every recurring tool with plan level and seat count. Map each to a cost center and owner. Mark the billing cycle and currency to prevent confusion. Opt for outsourcing inventory management for smooth processing

- Owners and service levels: Assign an internal owner who approves invoices and watches performance. Record vendor service levels for uptime and support response. Escalation paths save time when issues hit.

- Invoice intake and coding: Route invoices to a shared inbox or portal. Auto code by vendor where safe, then add a human check on the first few cycles. Reject invoices without a valid PO or contract link.

- Compliance documents: Collect W-9 or regional equivalents and required certificates. Set reminders for expiry dates. Use secure storage and access logs for audit comfort.

- Renewal calendar and alerts: Create alerts at ninety, thirty, and seven days before renewal. Include owner, current spend, and suggested action. Quick reviews stop quiet price creep.

- Risk and dependency notes: Tag critical vendors and note single points of failure. Add a fallback plan for the top few tools. Share this list with leadership during quarterly reviews.

A tidy vendor and subscription process removes noise from month-end and protects cash. Pair it with clear allocation rules, and your Remote cost accounting will run smoothly from the first quarter.

Reporting cadence and success metrics for Remote cost accounting

Good reporting turns bookkeeping into decisions. Keep the pack small and focused so action is easy.

- Monthly packet: Send a management P and L with cost center views, a balance sheet, and cash flow. Add a one-page summary with top variances and notes on what changed. Link to detailed schedules for deeper review.

- Cost driver dashboards: Track the main drivers chosen at kickoff. Show month-over-month trends and budget variance on a simple chart. Call out renewal dates or unusual spikes.

- Unit economics: Where it fits, show cost per unit, such as cost per order, seat, or lead. Simple math makes performance easier to compare across months. Use the same definitions every time.

- Exceptions and risks: List uncoded items, missing invoices, or unusual vendor activity. Add the owner and due date for each fix. Keep a small risk watchlist so nothing is a surprise.

- Cadence and improvements: Meet monthly to review and quarterly to refine the model. End each session with two improvements to ship before the next review. Small, steady changes beat big overhauls.

When reports are this clear, leaders stop chasing numbers and start making choices. That is the point of Remote cost accounting done right. Check this use case for reference.

Conclusion

Whether you’re a founder or a finance lead, clean numbers without a heavy lift are the goal. A simple onboarding flow makes Remote cost accounting predictable from day one. You provide a small set of inputs, the team sets clear routines, and together you produce reports that support confident decisions.

If you follow this checklist, you will see fewer delays, faster closes, and better cost visibility within the first month. Keep the routines light, document the few rules that matter, and let the cadence do the work. Share this plan with everyone involved so timelines and responsibilities stay clear.

If you want a quick readiness check, start by gathering the items in the first section and mapping your top five cost drivers. That alone will surface gaps and give you immediate next steps for a smoother first close.

About Us

Tasks Expert offers top-tier virtual assistant services from highly skilled professionals based in India. Our VAs handle a wide range of tasks, from part time personal assistant to specialized services like remote it support services, professional bookkeeping service etc. Furthermore, it helps businesses worldwide streamline operations and boost productivity.

Ready to elevate your business? Book a Call and let Tasks Expert take care of the rest.