Introduction

Accounting isn’t a one-size-fits-all process. By 2025, businesses will separate management accounting from financial accounting to achieve compliance and strategy equilibrium. Hence, it becomes necessary to understand the difference between Management Accounting Vs Financial Accounting

Financial reporting provides common reports for external users.

The object of management accounting is to generate information to make decisions with.

Both are important, and in advanced financial management solutions, they now live in harmony. Professionals such as financial management associates are instrumental in addressing the two approaches, balancing compliance activities with strategic growth and long-term financial planning, and wealth management.

What is Financial Accounting?

Financial accounting reflects a company’s past performances, according to standards such as GAAP or IFRS.

Key features:

- Outward focus: Data is directed to investors, creditors, and regulators.

- Standard reports: income statements, balance sheets, and cash flow statements.

- Historical data: Looks to the past at performance and transactions.

- Compliance-driven: Ensures regulatory transparency.

For smaller companies, hiring Stessa Bookkeeping Services will provide quick and hassle-free financial reporting that is both accurate and in compliance, without having to build an army of internal resources.

Also Read: Liability Financial Accounting

What is Management Accounting?

Management accounting refers to the use of internal data to assist in running a company and making business decisions.

Key features:

- Introspective: Aids management in decision-making.

- Customized reporting: As per the company requirement(Budget, Reports, Performance report).

- Forward-leaning: Predictive data is used for planning.

- Decision Support: Costing, break-even points, performance measures.

For example, A retail company that is using management reports to determine its pricing strategy for seasonal items.

Managerial accounting contrasts with the previously mentioned studies in that it is not as much about compliance as it is about helping to increase efficiency and profitability within an organization.

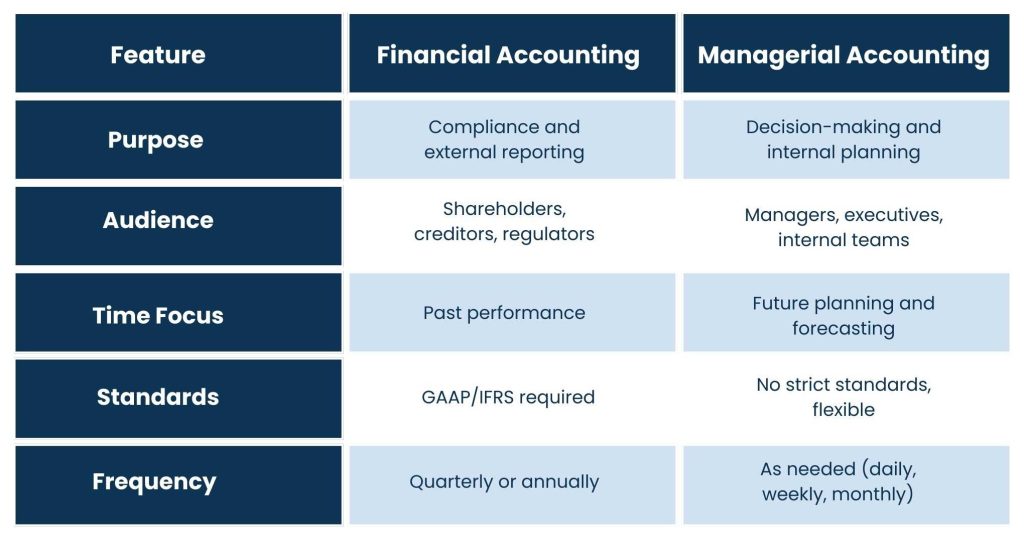

Management Accounting Vs Financial Accounting

Takeaway: Financial accounting maintains transparency, while management accounting drives performance and growth.

Also Read: Financial Management Software

The Role of Financial Management Associates

A financial management associate frequently bridges both:

- Facilitating audit reports for financial accounting.

- Applying financial management software to produce managerial information.

- Support with budgets, forecasts & KPI tracking.

- Serving as a link between regulatory requirements and internal management needs.

They are experts at both systems and assist companies to remain compliant while still being able to focus on profit.

Financial Management Software: The Bridge Between Both Parties

With new financial management software, both accounting types are part of the picture.

Key capabilities in 2025:

- Report out both ways: GAAP/IFRS financials + customized manager dashboards.

- AI-driven predictions: Predict future cash flows and costs for better decision making.

- ERP connection: Connect accounting to HR, supply chain, and CRM process flows.

- Automation: Reducing the number of errors associated with a manual process and increasing the frequency of reporting.

For example, as highlighted in Accounting Assurance Services and Risk Management, the companies are relying more and more on software, not only for making reports, but also for monitoring compliance with future financial risk.

Significance of Financial Planning and Wealth Management

Both types of accounting serve distinct roles in financial planning and wealth management:

- Historical information must be accurately represented by performance for tax planning and compliance with your financial accounting.

- It helps you make better investment and operational decisions.

- Together, they play an important role in making compliant and growth-oriented strategies.

These days, software and managers of wealth lean so heavily on software that does both that they’re planning top-down.

Best Practices in 2025

To take full advantage of both financial and managerial accounting:

- Buy integrated software for compliance + strategy.

- Farm out to bookkeeping pros compliance-heavy duties.

- Teach representatives to properly handle both methods of reporting.

- Connect your KPIs to strategy, and make sure that your managerial insights align with your company’s goals.

- Review regularly to stay agile in fast-paced markets.

Conclusion

It is no longer the management accounting vs financial accounting debate in 2025, but more of how the two need each other.

- By recording financial transactions, financial accounting also promotes an environment of compliance and trust.

- Management accounting affects decision-making processes, efficiency, as well as the growth of the business.

Prompt financial management with the help of financial management executives and advanced financial management software can help organisations to embed compliance within their strategy. With services such as Stessa Bookkeeping Services and next-gen accounting assurance support, managing both becomes easier with a strategic focus on long-term success in financial planning and wealth management.

Frequently Asked Questions

Financial accounting is external to the organisation, and management accounting is for internal use for decision-making.

Owners, lenders, regulators, and the public.

Managers and internal teams for planning and performance tracking.

It can be used to generate standardized financial reports as well as any ad hoc reports.

Yes, finance associates typically straddle both systems with some software.

About Us

Tasks Expert offers top-tier virtual assistant services from highly skilled professionals based in India. Our VAs handle a wide range of tasks, from part time personal assistant to specialized services like remote it support services, professional bookkeeping service etc. Furthermore, it helps businesses worldwide streamline operations and boost productivity.

Ready to elevate your business? Book a Call and let Tasks Expert take care of the rest.