Secure & Compliant KYC/AML Process Support for Your Business

Our Customer-Centric

Philosophy

Integrity

We uphold strict compliance standards, ensuring every KYC/AML check is conducted with full transparency, ethical handling, and adherence to regulatory guidelines.

Flexibility

Our support adapts to your compliance needs—whether onboarding customers, updating records, or handling periodic reviews—across regions and regulatory frameworks.

Accountability

We take ownership of each step, maintaining detailed records and audit trails to ensure regulatory reporting and risk management are always up to date.

Competency

Our trained compliance professionals bring deep expertise in global KYC/AML protocols, delivering accurate and efficient verification processes at scale.

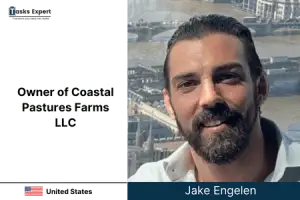

Hear What Others Say About Tasks Expert's KYC/AML Process Support

Know how our KYC/AML process support have helped various businesses succeed by increasing productivity and also cutting expenses.

Our Services

The Best KYC/AML process support for Your Business

Manual Document

Verification

User Onboarding

Support

Sanctions & Watchlist

Screening

Escalation of

Red Flags

Live Chat &

Email Assistance

Risk

Monitoring

Reporting

Assistance

KYC Platform

Support

Updating KYC

Records

Multi-Region

Compliance

Awareness

Training & SOP

Following

Customer Success

Coordination

Just 4 Steps to Hire KYC/AML Process Support

With our support, hiring KYC/AML process support is easy and seamless.

Schedule a Meeting

Connect with our Customer Success Manager to discuss your needs and define the tasks you want assistance with.

Choose Your Virtual Assistant

Select the VA that best fits your requirements from our pool of experienced professionals.

Get Started Quickly

Begin working with your Virtual Assistant within 24 hours to 1 week, depending on your preferences and onboarding process.

Access My Tasks Expert App

Gain full access to our secure Client Portal for seamless task management and communication.

Ready to Take the Next Step?

Schedule a meeting with our experts to discuss your plans and find the perfect solution for your needs.

Seamless Integration into Your KYC/AML Process

Once onboarded, our compliance assistant is trained on your internal systems and checklist. They manage new user verifications, handle flagged applications, respond to user queries, and assist with regulatory reporting as needed. Flexible hourly or monthly packages are available.

ID & Document Review

Check photo ID, proof of address, and selfie verification with accuracy.

Sanctions & PEP Checks

Run screening against OFAC, EU, UN, and global risk databases.

Onboarding Assistance

Help users upload docs, resolve verification issues, and reduce churn.

Risk Monitoring & Reporting

Track suspicious activity and generate daily/weekly compliance logs.

Reviewed on

We are Founded

Clients Trust Us

Completed

Frequently Asked Questions

We work with tools like Sumsub, Jumio, ShuftiPro, Veriff, and custom-built platforms.

Yes. Our agents are trained to check IDs, selfies, and utility bills for consistency.

Absolutely. We provide live support or chat assistance to help users complete verification smoothly.

We escalate red flags and maintain logs for your compliance officer to review.

Yes. We follow FATF guidelines and adapt to your local/regional compliance requirements.

Yes. Our assistants are trained to recognize suspicious indicators and handle them per SOP.

Yes. We can assist in logging and tracking unusual behavior and reporting patterns.

We assist in compiling data for SARs (Suspicious Activity Reports) and monthly summaries.

Support can be provided 24/7 or in your local time zone, based on the plan.

Yes. We follow strict data protection protocols and can sign NDAs or DPAs if required.