Introduction

One of leadership’s most valuable assets in a growing business is bandwidth. Founders, CEOs, and senior managers must establish the vision, the strategy and help the team with market entry. Instead, they’re often weighed down by spreadsheets, tax deadlines, and compliance matters.

This is where outsourced CPA services can make a world of difference. Through outsourcing financial and accounting services to trained outsourced professionals, corporations release their internal leadership to focus on core goals. It’s not just a matter of saving time; it’s about freeing up capacity for creativity, agility, and long-term growth. Whether you’re a new startup charging toward product-market fit or a grown-up business ready to manage expenses, CPA outsourcing provides flexibility, accuracy, and peace of mind. It means your finance doesn’t just support the business, it accelerates it.

Why The Leaders Should Not Be Bookkeepers

When it comes to business, founders and executives frequently wear many hats. CEOs have been known to run payroll, reconcile bank statements, and prepare financial reports on their own. This sort of determination can be a good way to cover overhead early on, but as a company scales, it is just not sustainable and introduces a whole host of new concerns around regulatory uncertainty.

Every hour you’re trying to make sense of spreadsheets or dealing with tax filings is an hour you’re not spending working on strategic initiatives around things like customer development, investor relations, or hiring. Just as companies change, so should the way they handle finance. The practice of adding accountability, bug reports, and forensics to leadership not only brings fatigue, but it also misses a large number of errors and provides insights later.

These costs often exceed the believed savings of keeping financial tasks in-house. Outsourcing CPA services offers a smarter alternative. Certified professionals bring both technical expertise and strategic guidance to the table. They specialize in:

1. Financial reporting and forecasting:

Provide accurate, timely financial support for better decision-making and to maintain the investors’ trust.

2. Budget planning and analysis:

Assisting leaders in the optimal allocation of resources, including raising financial reporting standards for the U.S. federal government so that leaders can identify cost-savings initiatives and understand where they need cash.

3. Tax compliance and audit preparation:

Help make sense of complicated tax codes and make sure your business is 100% audit-ready, which means less risk for penalties.

4. Cash-flow management:

Watching the money coming in and the money going out to make sure the business maintains liquidity, and doesn’t experience a cash crunch.

5. GAAP and regulation alignment:

Making sure financial practices meet the mandated accounting guidelines, integral especially for companies that intend to raise capital or file for going public. What makes outsourced CPA services different is the added value with a perspective that is beyond simple number-crunching.

These experts take the data and put it into action, identify patterns, expose risk, and bring to life growth opportunities that internal teams might overlook. Plus, many of the CPA services leverage cloud-based tools that can provide real-time dashboards, auto reporting, and, of course, the ability to work together in real time. This allows leadership to be able to pull instant financial health metrics without having to search for and sift through documents or rely on delayed monthly recaps.

Finally, delegating these duties provides leaders with the freedom to concentrate on what matters most: developing the business. Rather than reacting to financial challenges, they are enabled to turn the company onto the road to sustainable success, aware of where they are and where they are going.

In other words, delegating financial tasks to skilled experts is not just a transfer of work; it’s a strategic decision that strengthens efficiency, accuracy, and growth.

Also Read: Virtual Assistant Services in Fredrikstad

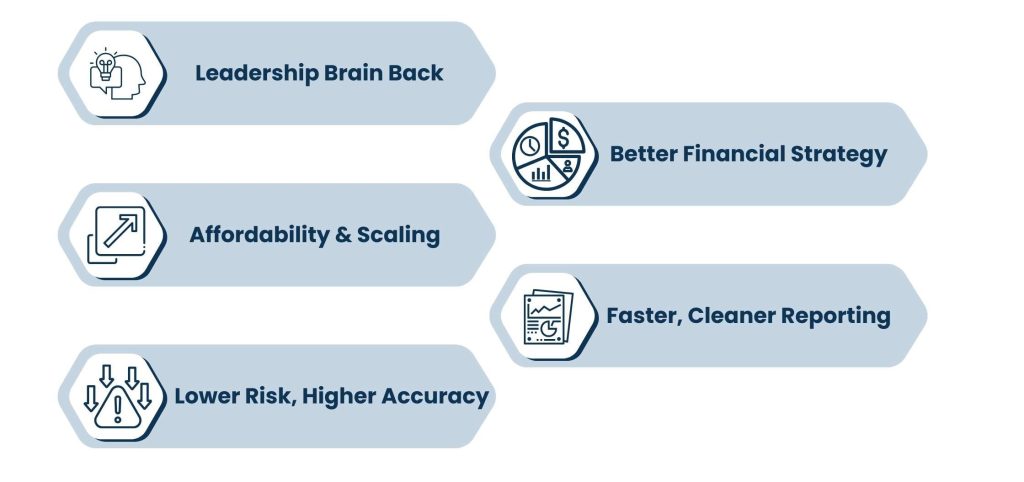

Benefits of Outsourcing CPA services for Small businesses

1. Leadership Brain Back:

When you outsource CPA services, your leaders are free from tactical noise and can utilize their brains on relationship-building, exploratory market research, and strategy execution.

2. Affordability & Scaling

Full-time CPAs are not cheap. Outsourcing gives you access to the same quality of work without the overhead of a full-time hire, allowing you to waive salaries, benefits, and training.

3. Lower Risk, Higher Accuracy

CPA firms are up to date with new laws and tax codes. This minimizes the risk of expensive mistakes and liability, particularly for startups without large in-house teams.

4. Better Financial Strategy

Firms running on external CPAs often do so on the basis of a strategy. They interpret financial data and refine forecasts and the optimization of cash flow, core topics directly influencing a business’s success.

5. Faster, Cleaner Reporting

Time is precious, and decisions are more crucial than ever, so real-time financials are a must. You are more likely to find time, monthly closes, financial dashboards, and investor-ready reports with outsource accounting.

CPA Services for Start-up Growth

Startups, in particular, have a lot to benefit from outsourcing CPA services. Early-stage companies don’t have the luxury of operating as freely as established companies. They are typically struggling to wear many different hats: product development, customer acquisition, hiring, fundraising, etc. With the speed of modern society, financial hygiene can often fall through the cracks. But, along the unstable path of entrepreneurship, even the most exciting ventures can flop if they’re not properly managed financially.

By outsourcing CPA services, startups gain access to crucial expertise without the full-time salary overhead. These professionals aren’t merely “keeping the books;” they are financial architects who can help startups establish the foundation.

Outsourced CPA Services for Startups include:

1. Clean financials for investor reporting:

Venture investors struggle to value their only asset due to unclear financials. Good balance sheets and profit and loss statements make startups more attractive and credible when fundraising.

2. Tax structure advice to maximise deductions:

Startups are eligible for a range of tax benefits, but you may not realise which if you don’t seek some expert advice on how your business should be structured for tax. CPAs ensure you your entity structures, expenses, and credits are maximized.

3. Creating a budget, tracking a burn rate:

A key to avoid cash flow crises is to know your burn rate. CPAs create a solid foundation of budgeting processes that provides leadership a clear picture of runway and funding milestones.

4. Audit readiness:

As you scale your startup or gear up for Series A/B funding, audits are inevitable. CPA professionals prepare and maintain records to facilitate unobtrusive, efficient audits.

But the benefits go beyond compliance and reporting. CPA services also allow for proactive financial planning, scenario modeling, and planning, must-have addons for business owners and individuals looking to stay on top of their financial tools while pivoting or entering new markets.”

Outsourced help often comes with advanced systems that allow founders to use dashboards, KPIs,forecast information to make better decisions. They will also bring a much-needed stability. It’s just that startups grow incredibly quickly, high turnover and role fluidity can create lapses in fiscal accountability. Having an external team in place takes away from that argument because it creates consistency and accuracy and institutional memory, no matter what happens on the inside.

Finally, it’s about speed. Startups move at a fast pace, and contracted CPAs are cut for quick turnaround. They can spin around financial reports, answer due diligence requests, and react to changing priorities quicker than the same in-house hire and learn on the job. Simply put, outsourcing accounting services is one of the best moves a startup can make in its early days. It brings expertise, structure, and credibility, so founders can innovate, build, and win in the market.

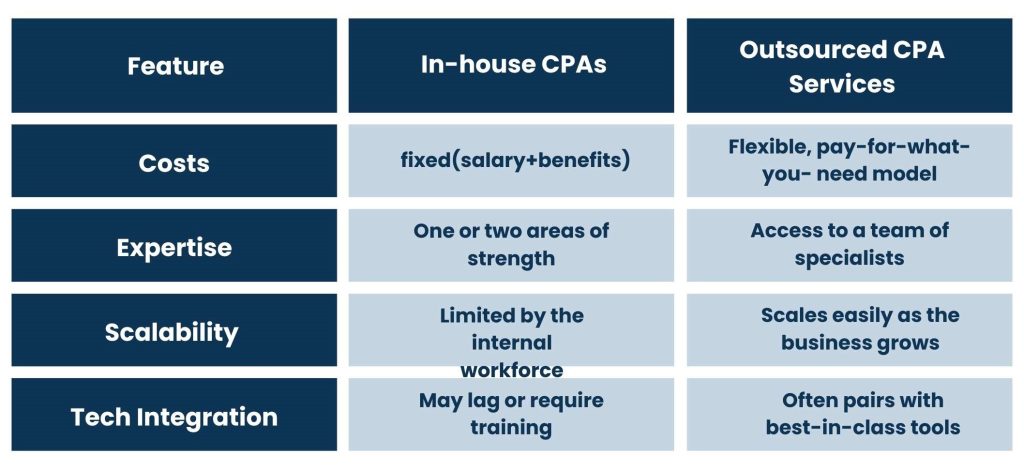

Outsourcing CPA Services vs. In-House Hiring

How to Successfully Outsource CPA Services

Outsourcing CPA services can help streamline your financial operations and free up leadership to focus on strategic growth. But for these superpowers to really be accessible, one must come at the process with intention.

Here’s how to do it right:

1. Define Your Needs:

Begin with the category of service that you need. Do you need help with simple bookkeeping, monthly financial reports, Tax Planning, or fractional CFO services? A well-defined scope allows you to narrow in on providers with the exact expertise you need. What you need to know has to be as specific as possible so that they can shape it appropriately.

2. Carefully check and verify your service providers

Not all outsource providers can be trusted equally. Find CPA services with experience in working with businesses of your size and industry, especially if you’re a startup. Look for companies that are tech-savvy and utilize cloud-based software such as QuickBooks Online, Xero, or NetSuite. If the proof is in the pudding, have them prove it with client references and case studies.

3. Clarify Expectations Early on:

The best outsourcing relationships start with a clear understanding on both sides. Set KPIs, deadlines for deliverables, and communication flow. Will they deliver the monthly financial reports by the 5th of the month? Will there be a dedicated person for you to contact? These little details prevent friction and future misunderstandings.

4. Continue to Stay Engaged and Collaborate:

Just because you delegated the accounting out to someone else, it doesn’t mean you turn your back on things. Have occasional check-ins and planning sessions to stay on the same page about goals. OutsourcedCPAs can provide strategic advice, but only if they have visibility into your business roadmap, cash flow fears, and upcoming changes.

By executing these four actions, you will ensure your outsourced accounting solution becomes a long-term asset to your business – not just a Band-Aid fix.

Also Read: Virtual Assistant Services in Kristiansand

Common Mistakes to Avoid When Outsourcing Accounting

There are many advantages to outsourcing CPA services, but failure to avoid these outsourcing accounting mistakes may reduce the value of these benefits. By solving these early on, you will build a successful long-term relationship with them that will help drive your strategic goals.

1. Choosing Based on Price Alone

The lowest-priced service is a recipe for poor service and little expertise. Cheap companies may trim costs or use old equipment and may not always know the industry. Always weigh a company’s reputation (history, your comfort with it, and client testimonials) and its services against those of another. A little more investment frequently brings significantly more accuracy, reliability, and strategic contribution.

2. Not setting proper Expectations

Related to miscommunication, particularly regarding expectations, not setting clear expectations results in missed deadlines, low-quality deliverables, and frustration on both sides. Be clear about what success looks like: weekly reporting, response times, escalations, access to financial dashboards. Clear transparency upfront creates a collaborative, low-friction working relationship that is more likely to provide long-term value.

3. Lack Of Internal Oversight

Just because you outsource something doesn’t mean you aren’t still on the hook if something goes wrong. Appoint an informed internal stakeholder to serve as the go-to between your business and the external CPA team. It also makes sure your performance is tracked, your challenges are solved promptly, and your financial plan continues to keep pace with the growth of your company and shifting priorities.

By steering clear of these errors, not only are you safeguarding the ROI on your outsourced accounting decision, but you are also establishing a partnership that drives efficiency in both operations and long-lasting strategies.

The Strategic Edge of Outsourcing Accounting Services

Outsourcing accounting is not only a reaction to streamline efficiencies, but it’s a proactive approach to reinventing your business altogether. If it’s done correctly, it incorporates financial clarity into the rest of your decision-making process. Outsourced services can offer industry benchmarking, up-to-the-minute analytics, and cloud-based tools that will revolutionize the efficiency and accuracy of your work.

Instead of wasting resources on discovery, leadership can concentrate on getting products to market, serving customers, and gaining market share. And it’s not just big companies that have the strategic advantage. And it’s critical for startups and scale-ups that need to do more with less.

Conclusion:

Outsourcing CPA services isn’t only for saving money, it lets leadership do what it does best: lead. ‘Every hour a business leader reconciling books and ensuring compliance is an hour lost to crafting strategy, driving growth, or nurturing customers.’ CPA Outsourcing looks to take that time, time we all lose as a way of life, and turn it into real strategic value.

Our reliable partner, who provides outsourcing CPA services, can help your business identify wasteful processes, enhance precision, and gain a competitive edge. By streamlining tax preparation to building out live dashboards for forecasting, outsourced CPAs transform raw financial data into decisions you can execute on.

Clarity can make all the difference for startups or fast-scaling businesses. The value of looking at the long-term ROI of outsourcing isn’t just the slight (but important) cost savings, it comes in the form of faster execution, smarter risk management, and stronger leadership.

If you’re looking for CPA services for startups, write-ups, or just want to stop juggling too many tasks and get back to the vision business, let Tasks Expert connect you to the right talent to get it done right.

About Us

Tasks Expert offers top-tier virtual assistant services from highly skilled professionals based in India. Our VAs handle a wide range of tasks, from part time personal assistant to specialized services like remote it support services, professional bookkeeping service etc. Furthermore, it helps businesses worldwide streamline operations and boost productivity.

Ready to elevate your business? Book a Call and let Tasks Expert take care of the rest.