Introduction

Business Valuation Services go beyond numbers; they assess your company in the broader market context. These days, market trends can have a significant and immediate impact on your business value. Industry demand, investor sentiment, competitor activity are some factors that can raise or lower your valuation, even if your internal numbers stay the same.

For instance, if a company serves an expanding market, it could be rewarded with increased buyer interest and richer valuation multiples. Conversely, working in an industry that is declining or in decline can erode perceived value, whether or not you’re profitable. It’s why business valuation experts consider more than just your balance sheet—they look at where your business falls within the current market conditions.

Tools such as a business valuation calculator provide a lens to interpret the numbers that yields insight. Whether you’re preparing your company for growth, for a sale, or just examining coming moves, knowing how external forces influence value is vital. Learning how to value a business properly means taking a hard look at the market in which the business operates.

Industry Demand Influences Value

Business Valuation Services start with one simple question: what is your business worth today —against others in your industry? The solution is not in your revenue or profit margin. It’s also driven by how the market views your sector of the economy. When there’s a great deal of demand in your sector, buyers are much more prone to pay a premium. Even profitable businesses can be valued lower when interest fades. And that’s why market trends and that industry’s performance weigh so much on what your business is valued at.

Here is how industry demand factors into business valuation:

1. High-growth industries attract higher demand:

If you are in a rapidly expanding sector like renewable energy, SaaS, health tech etc., you could be rewarded with fatter valuation multiples. Buyers are willing to pay up more because they expect continuous growth.

2. Comparative benchmarking brings perspective:

Business valuation specialists lean on comparable transactions (or “comps”) in your industry to gauge your value. This also looks at recent acquisitions, deal sizes, and general buyer sentiment in your space.

3. Momentum within the industry affects risk perception:

In high-growth industries, investors consistently perceive less risk, which has an impact on your business’s valuation. Conversely, doing work in an oversaturated or shrinking industry may result in discounts — even if your financials are strong.

4. Small business valuations change along with market narrative:

When it comes to smaller businesses, particularly industry sentiment, it can make a difference. And even modest operations can attract outsized buyer interest if your sector is deemed “hot.”

5. Calculators are for numbers, real life is for context:

The typical business valuation calculator probably won’t take into account the real-time changes occurring in your industry. That’s what knowing how to value a business correctly comes down to, marrying the financials with external market analysis.

Whether you’re the buyer or seller, with Business Valuation Services, you are receiving a number based on industry context more than just a report. In a market on the rise, that may boost your position. In a slow one, it can assist you in plotting your next move. Knowing that demand shapes value, you are sure you are not reacting, but planning with clarity.

Also Read: Web services testing

Economic Conditions Shape Buyer Behavior

Business Valuation Services do not value in a vacuum; they value in the world of today’s good or difficult economy. The robust economy directly impacts buyer behavior, competition, and optimism. A weak or uncertain economy, however, tends to make investors more cautious, which often results in lower valuations, even though your business fundamentals may remain the same.

Econometric conditions determine the business’s value. Here’s how the econometric conditions affect your business valuation:

1. Buyer confidence drive value:

Users are more confident when markets are stable, and that confidence leads to valuations. This belief means higher offers and stronger valuation multiples. What happens in downturns is that people get risk-averse, and offers are lower across the board.

2. Interest rates shape the availability of capital:

In lower interest rate regimes, it is cheaper and easier to get your hands on capital. Buyers can more readily finance acquisitions, and that can push demand and valuations. Borrowing costs rise when rates increase, and many buyers may step back.

3. Valuation models don’t account for macroeconomic risk:

Certified valuation analysts all take inflation, currency risk, and trends in GDP into account when predicting your future cash flows. These macroeconomic data points impact discount rates and risk factors that are employed in commonly employed valuation methodologies.

4. Small business valuation is more influenced by external forces:

Smaller businesses are less profound than the bigger fish when markets are tested. Even though operations are stable, decreased customer spending or restricted credit markets can bring down the valuation opportunity.

5. More than just tools—the value of context:

Where a calculator may only output a result based on static inputs, seasoned advisors leverage the ability to factor these numbers against current economic context for a truer representation.

Knowing how to value a business in such times of changing economic seasons is important in order to decide properly. Valuation services help ensure your pricing expectations are based on internal gauges, while also being aware of the external landscape. Whether you have plans to sell or just want to plan your future, understanding how the economy affects buyer behavior can prepare your business for the road ahead.

Timing Can Be Everything (In Good And The Bad Ways)

Business Valuation Services consider more than just your financial well-being – they look at when they are taking that ‘financial pulse’. Timing figures largely in the valuation of a business, often more so than small business owners understand. You might have an excellent year financially, for example, but if you’re selling during an off-cycle for your industry or during a scary time on the market, your valuation might not qualify you for as big of a payday as you would have hoped.

Here’s why timing has an impact on business valuation:

1. Seasonality deflates or inflates results:

Many companies have some seasonality pushed back and forth, retail over the holidays, tax companies in Q1, tourism in summer months. Valuing a business at the height or bottom of a cycle can skew apparent performance unless carefully normalized by seasoned valuation professionals.

2. Policy and regulation changes:

New government regulations, tax incentives, or anything that might restrict an industry can have a real-time effect on valuation. If suddenly your sector has taken on a set of new compliance costs or had a new set of funding flows hit, it’s going to affect what buyers are prepared to pay.

3. Inflation and cost trends affect projections of profitability:

In periods of extensive inflation, costs increase more rapidly than revenues in many industries, reducing margins. Inflation Estimations Business valuation services that wish to be precise account for estimates of inflation and the effects of inflation on future earnings and cash flow.

4. Market timing can change perceived worth:

If you attempt to sell during a buyer’s market, when many firms are for sale but fewer buyers are in the market, offers may be lower because of the increased competition. Conversely, divesting when demand is high and supply is low can be a source of valuation premiums.

5. Basic tools often miss the impact of timing and seasonal shifts:

A simple business valuation calculator may not take into account market seasonality or economic conditions. Professional appraisers provide a lot more analysis by factoring in market and business conditions in conjunction with timing.

Knowing how to value a company is not only about what you value; it’s also about when you value it. Great timing can improve your valuation, and bad timing can drive down the appeal of what would otherwise be strong numbers. To time the valuation process right, a professional Business Valuation Services can tip the scales in favor of seeing your business in the best light in tune with market momentum, as well as strategic plans.

Also Read: Marketing Operations Services

Investor and Buyer Sentiment Counts

Business Valuation Services are about more than just numbers; they’re also about measuring how your company appears in the marketplace. Valuation is as much art as it is science; it is as much about subjective factors like investor sentiment, market buzz, and buyer expectations as it is about the numbers. The more appealing your sector and/or model is to the market, the more you can expect buyers to pony up.

Here’s how buyer and investor sentiment can impact business valuation directly:

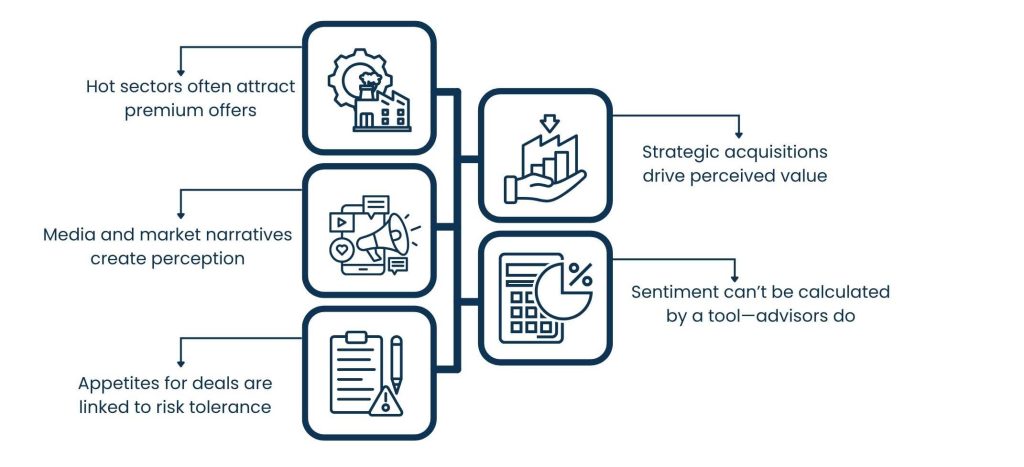

1. Hot sectors often attract premium offers:

If your industry is suddenly “in,” whatever it is: A.I., clean energy, digital health, some buyers will be excited enough to give you a higher combination of value. Even early-stage companies in hot markets can elicit strong interest and high prices.

2. Media and market narratives create perception:

Favorable press, market momentum, or recent round financing in your segment can make your business look more valuable by osmosis. Buyers frequently speculate on future value, especially in rapidly expanding sectors.

3. Appetites for deals are linked to risk tolerance:

When investors are feeling bullish, they’re willing to take on more risk and pursue pricier deals. In more conservative cycles, sentiment turns negative toward risky plays, and valuations are dragged down for outfits perceived as vulnerable or speculative.

4. Strategic acquisitions drive perceived value:

Buyers feel urgent when they observe others in the industry aggressively purchasing. That can drive demand and push valuations higher. That probably means the valuation expert continues to monitor similar transactions to figure out what buyers are thinking and what type of companies they’re interested in.

5. Sentiment can’t be calculated by a tool—advisors do:

A business valuation calculator won’t accurately capture changing buyer psychology, risk factors, or investment trends. That’s why it’s essential to depend on those who know the market and the mindset of active buyers.

To know how to properly value a business, it is essential that you think like a buyer. What are they looking for? What about your business model or market gets them excited? Business Valuation Services such as these can help you turn these emotional, amorphous concerns into actionable insights, shedding light on not just what your business is, but what the market believes it might be too.

Competition and Innovation Set Benchmarks

Business Valuation Services don’t just study your business in their bubble; they examine it in context of your industry and competitors. In today’s rapid markets, innovation and competitive performance influence how investments and acquisitions are valued by investors and buyers. If your competition is fundraising, getting big customers quickly, or releasing technology, they act as a benchmark that has a direct impact on your valuation.

Here’s how competition and innovation can impact the valuation of your business:

1. Innovative companies create new industry standards:

When businesses like those in your space are committing to new technologies, entering regional markets, or increasing brand equity, they are pushing the envelope on performance. If your business doesn’t keep up, buyers could view it as less valuable even if your numbers sail through due diligence.

2. Business valuation services do this:

One of the tenets of service for business valuation is comparison with businesses like yours. If your peers sold for a high multiple or just raised a ton of money, their valuation becomes a reference point.

3. Differentiation can support a premium.

Conversely, if your company is providing something one-of-a-kind, whether that’s a patented product, a fervent customer base, or a business model that’s impossible to replicate then you may be able to meet or exceed the top end of the market range. Innovation, and defensibility can command a premium price.

4. Competitive pressure affects buyer urgency:

If buyers believe others are doing a lot of buying in your area, then the FOMO (or fear of missing out) will motivate them. This can also raise demand and push the valuations of well-placed, competitive businesses higher.

5. Simple tools can’t account for market momentum:

A crudely constructed calculator may tell you a number only considering revenue and profit. But it’s not going to consider how your business compares in terms of innovation, brand positioning, or competitive edge.

If you want to figure out how to value a business, you need to understand the game you’re playing in. Business Valuation Services compare your numbers with those of your peers, to make sure your valuation doesn’t just represent what you’ve done so far, but also how well you are positioned for what you’re going to do.

Conclusion: Valuation Isn't Just Numbers - It's a Context sport, too

Business Valuation Services bring to life more than just a fiscal still-motion story; they provide a roadmap for strategic planning on where a business stands in the market and where it should go. What defines your value is how those numbers interact with trends, buyer perception, and the competitive landscape you’re operating in.

Market conditions can buoy or depress your value. The demand dynamics, economic sentiment, terms of innovation and trends, and the timing in all of this determine the way buyers perceive the potential you represent. And no calculator can take into account those nuances the way an experienced professional can.

Whether you’re gearing up for a sale, seeking investment, or simply looking to make a strategic move, armed with the ability to valuate a business right comes knowledge of how outside trends impact what you’re worth on the inside.

In the end, the best valuations aren’t just what your business is worth today; they are about helping you position for what it could be worth tomorrow. With expert guidance and real-time market intelligence, valuation becomes less of a mystery, and more of a smart business decision.

About Us

Tasks Expert offers top-tier virtual assistant services from highly skilled professionals based in India. Our VAs handle a wide range of tasks, from part time personal assistant to specialized services like remote it support services, professional bookkeeping service etc. Furthermore, it helps businesses worldwide streamline operations and boost productivity.

Ready to elevate your business? Book a Call and let Tasks Expert take care of the rest.