Introduction

AI-powered financial data solutions are now a strategic necessity for modern companies, not just science fiction. The old ways of managing money no longer work as businesses move more transactions, cross borders, and make decisions based on real-time information. Spreadsheets, delayed reports, and static forecasters can’t cope with the hyper-speed economy today.

This is where AI enters. By automating advanced data work and delivering intelligent insights, AI transforms financial operations from reaction to action. It sheds light on the complexity of recording risks before they become problems, identifying patterns humans may miss, and providing forecasts that allow leaders to plan with precision.

From predictive cash flow modeling and fraud detection to live dashboards and smart expense tracking, AI is revolutionizing the way companies handle money, avoid loss, and make better decisions—quicker.

In this blog, we’ll explore how AI is revolutionizing financial data solutions through real-world use cases, including fraud detection, real-time insights, and forecasting. Whether you’re a finance leader or business owner, these changes aren’t just helpful—they’re redefining how finance gets done.

Smarter Fraud Detection With Financial Data Solutions

Fraud detection has been a top concern among finance professionals in such industries as banking, insurance, and eCommerce for years. Historically, the conventional solution was predetermined rule sets—detecting transactions exceeding a minimum amount, uncharacteristic login geographies, or excessive volumes of activity within a short time frame. As useful as this has proven in some situations, this approach is reactive, inflexible, and exploitable by sophisticated fraudsters.

AI is changing this paradigm altogether. It learns behavioral patterns rather than merely flagging exceptions. It adapts to context and gets smarter over time, leading to proactive, adaptive fraud prevention that gets better with each additional flow of data through the system.

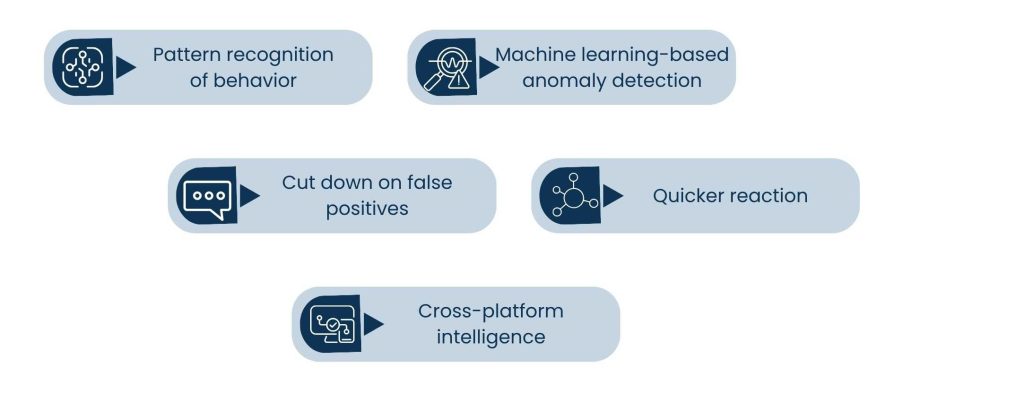

Here’s how AI enhances fraud detection:

1. Pattern recognition of behavior

AI-driven systems observe the way users normally behave. This includes the devices they use to interact with platforms, how much they spend, and where and when they transact. The system instantly notifies them when something significantly departs from this.

2. Machine learning-based anomaly detection

Legacy systems send alerts according to static thresholds. AI uses models based on machine learning that understand what constitutes “normal” behavior for every account. Because these models learn over time, they are able to identify even the smallest anomalies that rule-based techniques or human analysts could miss.

3. Cut down on false positives

Incorrectly stopping positive activity is one of the main complaints regarding fraud detection. Following an examination and approval of a transaction, AI models continuously modify their cut-offs based on the outcomes, thereby learning not to detect similar transactions in the future.

4. Quicker reaction

AI systems can instantly scan thousands of data points, alerting risk management teams or automatically stopping questionable transactions before they become a problem. That type of velocity is essential when a breach or attempted fraud is occurring.

5. Cross-platform intelligence

AI links different systems, such as payment processors, CRM, banking APIs, and device data, to provide a more comprehensive picture of fraud risk.

In addition, using AI to detect fraud, forward-thinking companies are also using it to predict and prevent it before it occurs. That is a significant improvement over conventional defenses. Additionally, AI’s capacity for learning and adaptation will continue to be a vital component of financial data protection methods as cyber threats continue to change.

Financial Data Solutions Enhances Planning with Foresight

Cash flow can sink or swim a company, particularly during its growth phase. Although old-school forecasting is based on spreadsheets and what happened in the past, it tends to break down when something unknown occurs. That’s where AI entirely revolutionizes. Rather than peeking into the rearview mirror, AI introduces genuine foresight into where the cash will flow through the company.

With AI-driven predictive cash flow models, finance teams get the power to plan with data-driven confidence. These tools do so much more than mere formulas based on static values—they learn by actively monitoring continuous activity, market trends, and buyer habits to predict future financial status with much greater accuracy.

This is how companies can apply AI to regulate cash flow with AI:

1. Real-time syncing of financial systems

AI-driven systems pull data directly from bank feeds, payroll, accounting, and invoicing. This bypasses the errors and lag associated with monthly reconciliations or manual input.

2. Identifying client behavior and seasonal patterns

Machine learning can determine customer payment trends, high/low sales periods, recurring expenses, etc. It creates a predictive model that changes with your company to identify changes before they become issues.

3. Scenario modeling

Companies can simulate a range of financial scenarios depending on variables such as increased revenue, delayed payables, or higher expenses by using AI software. You can see in real time how a possible hire or investment may impact your cash flow in the future.

4. Proactive alerts and risk signals

AI programs alert you when projected balances are approaching depletion or when payments are likely to arrive late, preventing you from discovering your cash shortage after it’s too late.. That provides leaders with time to react—whether it’s readjusting spend, pursuing receivables, or negotiating financing.

5. Budget flexibility and financial responsiveness

Predictive models enable CFOs and finance managers to link budgets with projected future cash flows, not fixed targets. This results in more responsive, adaptive financial planning.

Finally, AI sheds light on one of the most nebulous areas of business finance. It’s not merely a matter of having figures—it’s a matter of knowing what to do with them before things go wrong. That kind of foresight is a competitive edge that manual spreadsheets simply can’t provide. And for businesses seeking to grow responsibly, predictive cash flow fueled by AI is no longer optional—it’s required.

Real-Time Insights With Financial Data Solutions

In the world today, postponed financial reporting can take time, dollars, and opportunities from businesses. Waiting for month-end spreadsheets or hand-crafted reports no longer accommodates the rhythm of contemporary decision-making. Executives require insight in the moment, and AI provides that in the form of real-time financial insights.

Artificial intelligence-based financial data solutions revolutionize the way companies get to, understand, and respond to their numbers. These solutions automatically collect and analyze data from many systems—accounting software, CRM, billing platforms, bank feeds—then deliver that data in real-time dashboards or interactive reports.

This visibility in real-time provides business leaders with the ability to reply to changes instead of reacting to them.

Here’s how real-time AI-based insights are revolutionizing financial operations:

1. Integrated dashboards from several sources

Applications of AI connect data from multiple systems and combine them into a single, cohesive graphical user interface. You may access all of it without switching apps, including sales, costs, cash flow, and outstanding invoices.

2. Natural language query capabilities

Business users and finance teams can now ask inquiries in English, including “What was our net income last quarter?” thanks to several AI systems. Alternatively, “Which product category is performing below par this month?” Because the AI retrieves and provides results in real time, no prior familiarity with complicated reporting methodologies is required.

3. Automated financial reports

By providing daily, weekly, or ad hoc summaries suited to each stakeholder, AI systems can replace human work. These studies identify patterns, warn of abnormalities, and even make recommendations for future action.

4. KPI monitoring

Monthly meetings no longer need to wait for you to witness performance indicators. Teams can make adjustments based on real-time updates of key financial numbers like accounts payable, operating cash flow, and gross margin.

5. Speed up strategic decision-making

With real-time data, there is no need to wait for a trend to begin to act. Decisions can be made based on what is occurring currently, not last quarter, whether that is uncovering a leak of cash, modifying marketing spending, or making price adjustments.

Finance is less about reporting the past and more about shaping the present. As AI provides an ever-constant flow of intelligence, companies can go faster, remain leaner, and make better decisions. That kind of financial dexterity not only enhances internal operations—it becomes a competitive advantage that influences how you plan, scale, and expand.

Smart Expense Management With Financial Data Solutions

Manual tracking of spending is likely the most time-consuming and error-prone activity in any financial group. From receipt follow-up to manual transaction coding, the procedure drains resources and consistently results in delayed reports, flawed data, and areas of non-compliance.

That is why AI-backed expense management is on the rise. It takes the medium of tracking expenses and converts it into smart, automated processes, reducing friction, chasing away delays, and increasing transparency without adding micromanagement.

Here’s what AI is transforming in expense management for teams and businesses:

1. Receipt scanning and categorization by AI

Receipts can now be scanned with incredible accuracy by AI apps. Staff simply email or snap a photo, and the software recognizes vendor, amount, category, and date automatically—no keying necessary.

2. Intelligent coding and compliance with policy

Instead of relying on employees to remember accounting codes or policy limits, AI classifies expenses by context and company guidelines. When a purchase exceeds limits or is outside policy, it recognizes the potential issue immediately.

3. Duplicate and fraud identification

AI avoids expense fraud by flagging duplicates, abnormally large expenses, or patterns of misuse. It goes beyond set rules and understands what is normal behavior, so that it can signal abnormalities promptly.

4. Expense tracking in real time

Managers and financial teams may view expenditure in real time, rather than weeks later. Visibility reduces end-of-month shocks, keeps teams together, and gives more control over budgets.

5. Employee-friendly interface

AI-powered new tools tend to be easy to use. Without needing to comprehend financial operations, employees can use their cellphones to submit spending, receive immediate feedback, and spend less time on administrative tasks.

6. Readiness for compliance and audits

Each step is time-stamped and recorded, including approval, submission, and correction. Finance teams have a clear, plug-and-play, searchable record during audit season. AI systems even help with tax regulation compliance and reimbursement requirements across locations.

Businesses can reduce errors and save time while ensuring the greatest degree of transparency and compliance by using AI to automate expense management. Instead of chasing receipts or manually reconciling reports, finance professionals may spend more time advancing strategy, identifying opportunities for cost savings, and encouraging informed growth.

The cherry on top? Workers only need more intelligent tools, not more work.

Tailored Financial Planning and Guidance With Financial Data Solutions

In the past, customized financial planning was thought to be a luxury reserved for huge enterprises or the rich.

Customized financial planning was once considered a luxury for wealthy people or large corporations. It relied on human analysts, time-intensive analysis, and static assumptions. With artificial intelligence, the whole picture is extremely different. Personalized financial advice is now more widely available, scalable, and supported by data than before.

1. Robo-advisors, or automated financial advisors

Using AI, Wealthfront, Betterment, and other platforms build investing portfolios based on a client’s time horizon, goals, and risk tolerance.

2. Cash flow guidance for business and forecasting

AI technologies have now become intelligent business counselors for entrepreneurs and CFOs. They can analyze revenues, debt, period expenses, and trends in the industry to offer budgets, expansion, or risk mitigation recommendations and forecasts.

3. Personalized advice and notices

AI does not glance in the rearview mirror—it proactively provides you with insights on changes in financial health. For example, if your costs of operation are trending over target levels, it can notify you and suggest modifications to stay on budget.

4. Goal-based financial planning

AI allows individuals and institutions to plan against specific goals, like saving for expansion, reducing operational costs, or gaining profitability. The tools adjust in real-time as financial conditions change and reflect updated strategies.

5. Scalable planning for advisors

For advisory financial companies, AI means an enormous advantage in serving more clients without sacrificing personalization. Advisors may concentrate on developing relationships and providing high-leverage advice by using AI to handle laborious reporting, risk analysis, and performance tracking.

6. Connectivity to financial ecosystems

These applications don’t just happen to exist. They provide relevant, context-specific information and give a comprehensive picture of finances by integrating with bank accounts, accounting systems, payroll systems, and CRMs.

AI took investment advice from a very specialized offering and converted it into one that’s accessible, tailored, and continuous. As a business leader or a guide for individual goals, AI ensures every financial choice is informed by data, timely, and aligned with what matters most to you.

The Human + AI Partnership

AI is not coming to replace finance professionals; AI is coming to enable them to do their job better. Artificial intelligence does the kind of mundane, time-consuming work that keeps individuals from advancing. Financial Data Solutions may concentrate more on the things that really drive business by using it to automate tasks like data gathering, reconciliations, modeling, and anomaly detection.

Experts may focus on strategic planning, interpret high-level findings, improve projections, and provide leaders with accurate advice when AI takes care of the mundane tasks. They’re spending time making data-driven decisions based on trustworthy, real-time data rather than spending hours reading reports or monitoring statistics.

The real value is the higher intelligence this partnership creates, where AI brings operational depth, and humans contribute context, judgment, and imagination. Together, it’s a force multiplier.

This’s not merely a technical upgrade; it’s a cultural shift in the way finance is achieved. Firms that leap onto this model early are finding tighter financial flexibility, better forecasting, and more confidence behind every decision they’re making.

The future of finance isn’t a choice between man and machine; it’s about combining the two, on purpose. And in an information-flowing environment that has never been faster, that integration is no longer optional; it’s the new standard.

Conclusion

AI is revolutionizing the terrain of financial information in ways unimaginable a few years ago. AI is no longer a “nice to have”—it’s rapidly becoming a “must have” for businesses that need to remain keen, agile, and forward-capable. From cash flow forecasting and fraud forecasting to real-time analytics and automated expense tracking,

AI is remarkable because of its intelligence rather than its mechanization. Finance professionals’ capacity for learning, adaptation, and context-driven insights enables them to make better decisions faster. Teams may concentrate on strategy, performance, and growth rather than wasting time comparing spreadsheets or running reports.

AI-based financial data solutions provide vision through complexity and insight in the face of uncertainty. Whether you are a startup in its explosive growth stage or an enterprise wanting to rein in the purse strings.

It’s not about replacing people; it’s about equipping them to do their best work with tools that match the pace of today’s business.

As finance becomes more data-driven, high-speed, and leverages the speed of business, adopting AI isn’t just smart; it’s strategic.

About Us

Tasks Expert offers top-tier virtual assistant services from highly skilled professionals based in India. Our VAs handle a wide range of tasks, from part time personal assistant to specialized services like remote it support services, professional bookkeeping service etc. Furthermore, it helps businesses worldwide streamline operations and boost productivity.

Ready to elevate your business? Book a Call and let Tasks Expert take care of the rest.