Introduction

In businesses, finance, precision, and attention to detail are key. But for a lot of business owners and growing businesses, financial work can be a drain on more valuable activities like strategy, selling, and client development. That’s why more and more businesses are looking to Finance VA Outsourcing; the ability to delegate work like bookkeeping, reporting, and analysis tasks to skilled virtual assistants.

If you’re new to outsourcing, the Virtual Assistant Services page gives a complete overview of how VAs can transform daily operations beyond finance.

Rather than hiring expensive in-house workers, companies can outsource to finance VAs for tasks like keeping track of invoices or even budgets. This tactic not only cuts overhead costs but also ensures the organization’s financial staff will work cooperatively and effectively by providing a clear line of sight to business leaders, thereby empowering them to make better decisions.

In this post, we’ll look at the work of finance virtual assistants, what tasks they handle, the tools they use, and how outsourced financial support can revolutionize your business efficiency.

The Reason Why Companies Require Finance VA Outsourcing

What some businesses don’t realize is that outsourcing finance roles is about more than just pitting your potential salaries against the numbers thrown your way in an RFP. It’s a strategic choice to scale operations.

Some of the various reasons why businesses leverage on finance VA outsourcing are:

- Cost efficiency: Save on full-time salaries, benefits, and training.

- Precision: Experts available to manage your finances.

- Scale: We can easily shift VA hours based on workload and growth.

- Keep growth in view: Give leaders the space to focus on sales, strategy, and growth.

- Adaptability: VAs can assist with bookkeeping and payroll, or reporting as needed.

Outsourcing gives businesses a lean yet robust model for managing their financial workflows.

For businesses that prioritize responsiveness, our customer support services ensure client queries are handled with the same accuracy and cost efficiency as finance tasks.

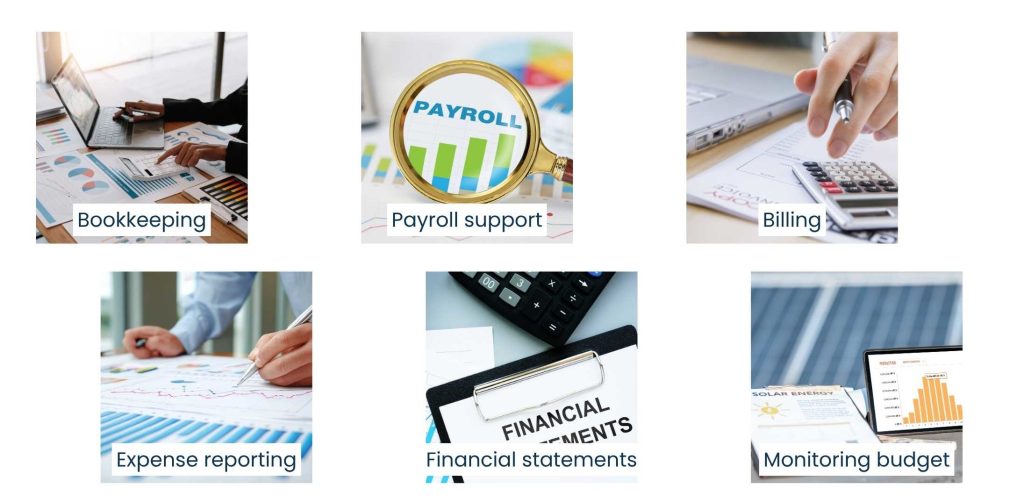

Responsibilities of a Finance Virtual Assistant

A financial VA juggles both general and specific duties.

Common roles include:

- Bookkeeping: Reconciling accounts and managing expenses.

- Payroll support: Coordinating with HR systems to prepare the data for payroll.

- Billing: Making, sending, and chasing payments on client bills.

- Expense reporting: Classifying business expenses for tax purposes.

- Financial statements: Preparing monthly or quarterly statements.

- Monitoring budget: Overseeing spending to maintain financial control.

Once these roles are filled, businesses will benefit from greater financial visibility without increasing burden on internal resources.

To see how VAs deliver measurable impact, explore our success stories that highlight efficiency gains across bookkeeping, payroll, and reporting.

Bookkeeping and Reporting Made Easy

Bookkeeping is a time-consuming yet pivotal task for most businesses. The finance VAs will offer a systematic, consistent method.

Bookkeeping and reporting tasks include:

- Recording daily transactions: Entering data for receipts and payments.

- Bank Reconciliation: Comparing bank statements and financial records.

- Cash flow monitoring: Tracking money on hand and predicting accumulations.

- Tax preparation support: Compiling receipts and preparing reports for accountants.

- Performance summaries: Developing dashboards for financial highlights.

This degree of organization guarantees that businesses are audit-ready and financially fit year in, year out.

Also Read: Affordable Virtual Assistant Services

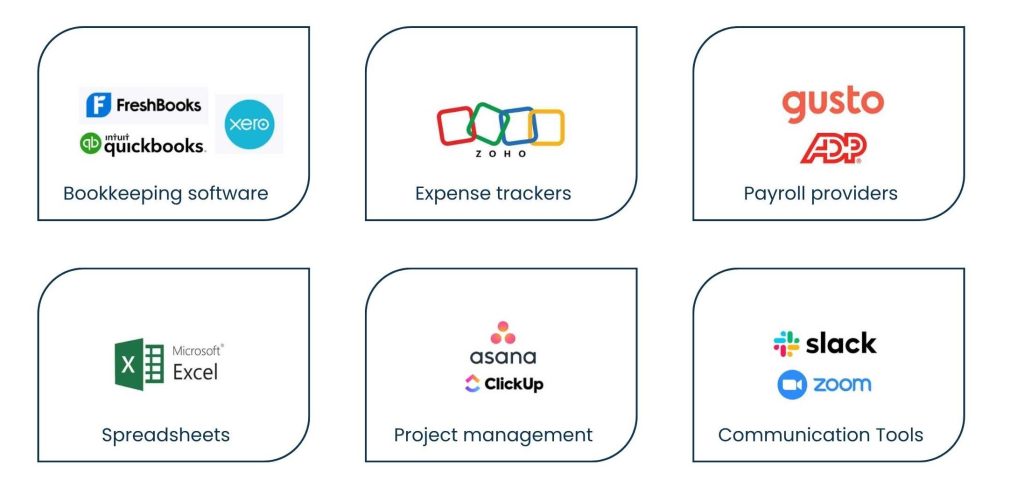

Instruments Finance VAs Use to Be Efficient

Technology enables the support of twenty-first-century finance, and virtual assistants are adept at selecting the right tools to do so.

Popular tools include:

- Bookkeeping software: QuickBooks, Xero, FreshBooks for keeping the books.

- Expense trackers: Use Zoho Expense for tracking business spending.

- Payroll providers: Go to Gusto or ADP for an easy payroll solution.

- Spreadsheets: Prepare customized reports via Excel or Google Sheets.

- Project management: Utilize Asana or ClickUp to keep the workflow transparent.

- Communication Tools: Communicating with the team through Slack or Zoom.

A finance VA merges professionalism with some tools and ensures that all businesses, small or large, have a streamlined financial process.

Benefits of Finance VA Outsourcing

There are clearly short and long-term advantages to outsourcing aspects of the financial function.

Key benefits include:

- Time Savings: Free executives from manual financial work.

- Less overhead: Save on full-time finance staff.

- Improved accuracy: Reducing the likelihood of errors on transactions and in reporting.

Accuracy is also a cornerstone in our Data Entry Virtual Assistant Services, where precision and speed directly influence business outcomes. - Make better decisions: Real-time financial insights and reporting.

- Scalability: Changing help as the business changes in size.

- Less stress: Entrepreneurs can relax knowing professionals are handling finances in a better way.

These benefits make finance VA outsourcing one of the smartest steps forward that developing businesses can take.

Finance VAs vs In-House Staff

Businesses often wrestle with the decision of whether to perform finance duties in-house or outsource them.

Key differences include:

- Cost: VAs are a fraction of the price of recruiting full-time finance staff.

- Flexibility: You can ramp up or down the hours via your outsourcing.

- Specialization: Finance VAs may be specialized in any industry or tool.

- They are location independent: VAs can work from anywhere, so there are no geographical restrictions.

- Resource allocation: In-house staff need training and management; VAs are already trained.

For the vast majority of small and midsize businesses, there’s a sweet spot between affordability and expertise in outsourcing.

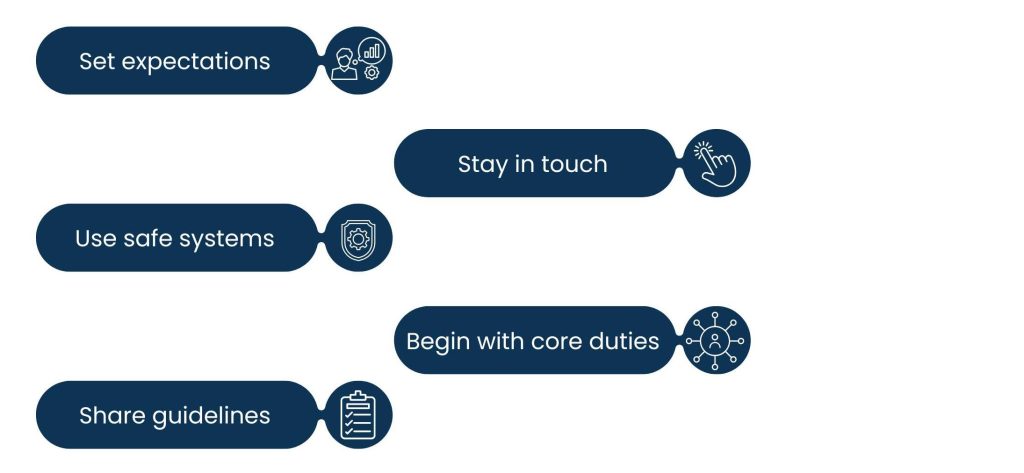

Tips on How To Work With a Finance VA

Organizations, if they want to get the most out of outsourcing, should think about it strategically.

Best practices include:

- Set expectations: Define roles and deadlines clearly.

- Use safe systems: Keep all sensitive information on encrypted tools.

- Share guidelines: Offer templates to train employees about the brand’s working style.

- Stay in touch: Schedule regular check-ins to discuss priorities.

- Begin with core duties: Build on bookkeeping or invoicing before, during more.

In this way, companies have peace of mind that things will run smoothly when working with their finance VA.

Conclusion

The trend towards finance VA outsourcing is growing, with businesses looking for cost-effective, responsive, and precise financial management. Entrepreneurs and businesses free up time, reduce costs, and get a better understanding of their bottom line by outsourcing the dirty work of bookkeeping, reporting, and other finance tasks to skilled VAs.

This change empowers leaders to spend their time on higher-value activities such as closing deals, innovating, and scaling, with the VA taking care of the foundation. In fact, for companies that want to operate leaner and more efficiently, outsourcing a finance virtual assistant is no longer a choice – it’s a necessity.

Here at Tasks Expert, we have professional Finance VAs that will give you the best industry-specific help!

If you’re ready to scale financial operations and beyond, visit our Contact Us page to discuss how we can match you with the right Finance VA.

Frequently Asked Questions

It is the outsourcing of the financial management side of your business, such as bookkeeping, invoicing, and reporting, to a trained virtual assistant.

Finance VAs are generally priced at $12–$25 per hour, which is cheaper compared to full-time hires.

Turns out, VAs do assist in the processing of payroll and business data for filing taxes.

They connect to QuickBooks, Xero, Excel, and other tools the finance team normally works with, so that it can speed up reporting and reconcile books.

Via secure platforms, NDAs, and password managers to protect sensitive information.

About Us

Tasks Expert offers top-tier virtual assistant services from highly skilled professionals based in India. Our VAs handle a wide range of tasks, from part time personal assistant to specialized services like remote it support services, professional bookkeeping service etc. Furthermore, it helps businesses worldwide streamline operations and boost productivity.

Ready to elevate your business? Book a Call and let Tasks Expert take care of the rest.