Introduction

Compliance Automation becomes mandatory and not a choice for small firms. Rules and regulations such as data privacy legislation, health and safety in the workplace, and accounting reporting are quite complicated and time-consuming to deal with manually. Mistakes not only result in penalties but also spoil the reputation of a business.

This is where automation of compliance enters the scene. It substitutes redundant, manual compliance work with technology-based processes, allowing small companies to remain on top of their commitments without depleting time and money. Automation prevents collapsing anything, from automated reminder-based tracking of document deadlines to instant policy updates

Moreover, modern compliance automation tools are now accessible and affordable, allowing even budget-conscious companies to achieve accuracy and efficiency as large enterprises.

In this blog, we’ll explore practical, budget-friendly strategies for small businesses to adopt compliance automation, highlighting how it can streamline operations, improve accuracy, and keep your business audit-ready all year round.

Identify Compliance Priorities Before Compliance Automation

Labour-intensive small firms must plan what and when to automate in advance. Businesses with few assets can find automation costly, disruptive, and hard to control.

The first is to correctly comprehend your regulatory obligations. These are:

1. Reviewing responsibilities:

Compile information on every relevant industry-related law, including HIPAA for healthcare privacy, GDPR for data protection, and OSHA for workplace safety. You can quickly determine the extent of your requirements using our thorough compliance checklist.

2. Assessing pain points:

Seek out repetitive, time-consuming processes that often result in mistakes when done manually. For instance, keeping employee training records, tracking license renewals, or generating monthly compliance reports.

3. Beginning with high-risk processes:

Automate where mistakes might result in major fines or lawsuits, like employee safety records, tax filings for payroll, or accuracy in financial reporting. Those are where automation can make the quickest and biggest difference.

4. Developing a phased plan:

Divide implementation automation into manageable phases. Begin with a small number of processes, pilot the effectiveness of the system, and then move into other areas as you gain familiarity with it. This process staggers expenses, lessens operational pressure, and lets you optimize workflows along the way.

Your time and budget are being used on changes that yield the highest returns by prioritizing in this manner. It also prevents the most common trap of over-automation, where companies go for technology that makes things more complicated without quantifiable value.

For instance, a tiny building firm may start by automating the tracking of safety compliance to stay away from OSHA fines. When this is in position and running well, they might then proceed to automate compliance with documentation projects and ultimately include environmental reporting procedures. This incremental build maintains the company in command while continuously enhancing compliance functions.

You get a better return on investment and facilitate a more seamless transition for your team if you begin with your most urgent compliance requirements and grow strategically. Ensuring that the technology supports your business objectives, as it is the foundation for effective compliance automation.

Use Affordable, Scalable Compliance Tools with Compliance Automation

You don’t have to break the bank on enterprise-level tools to enjoy compliance automation. There are several cost-effective solutions specifically tailored for small firms. Providing necessary features without the excessive complexity or price tag of bigger systems. Making the right tool choices up front can help you maintain compliance economically while staying within budget.

To choose the right software, small companies should:

- Look at cloud-based compliance systems: They are subscription-based, don’t have expensive upfront costs, and can be accessed remotely. They also update themselves to keep up with changes in regulation, leaving your time free from doing it manually.

- File under module-based solutions: Instead of investing in a system that sings and dances and does everything but, select modules for discrete needs, such as policy management, monitoring employee training, or audit readiness.

- File under integration functionality: Solutions that are integrated with your existing payroll, HR, or accounting platforms reduce the number of duplicate data entries and eliminate discrepancies.

- Break with free trials or special offers: The majority of compliance software providers offer trial products or smaller plans that are perfect for trying out functionality before committing.

Low cost does not necessarily mean low end. There are many low-cost compliance software products with full-featured capabilities such as automated reminders for license renewal, expiration dates on documents, and compliance checklists. That can be customized, and access controls based on roles. For example, a small medical practice can have a HIPAA-compliant document management system to handle patient data privacy responsibilities without buying an entire enterprise solution.

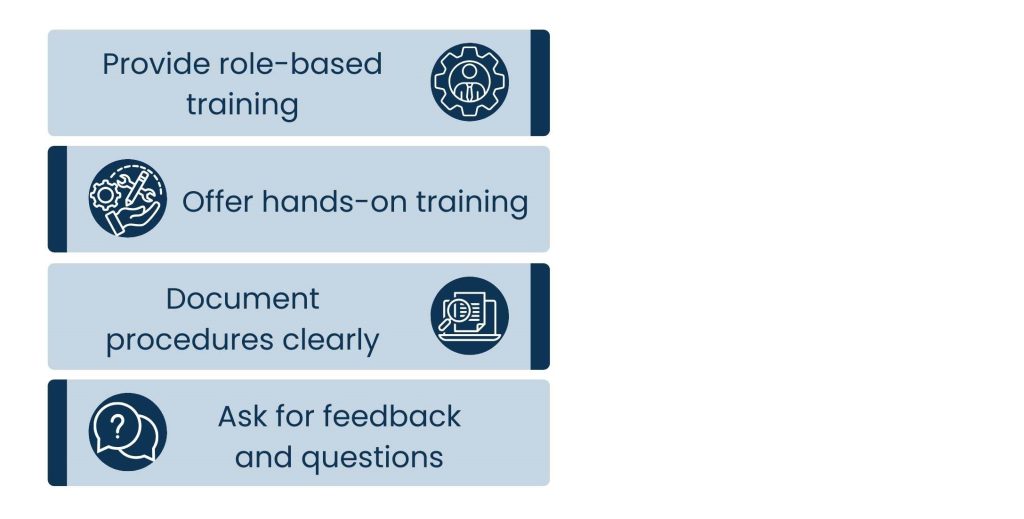

Train Teams to Work with Compliance Automation

The strength of the people using it determines how effective even the most advanced compliance automation tool is. Unrealized automation, manual procedures, and the danger of non-compliance can all persist in the absence of proper training. Training helps your staff not just learn how to use the software, but also why automation is essential for accuracy and efficiency.

To make training worthwhile and applicable, small businesses ought to:

- Provide role-based training: Don’t give employees too much information. Instead, train sessions on the exact compliance features that each team member will utilize. HR personnel, for instance, can be trained on employee record compliance, while accounting teams can be trained on financial reporting tools.

- Offer hands-on training: Allow team members to navigate actual compliance situations in the system. This creates comfort and limits the learning curve.

- Document procedures clearly: Design step-by-step instructions or quick reference guides that employees can refer to while undertaking compliance activities.

- Ask for feedback and questions: Employees will be more receptive to new tools if they believe their questions are heard and answered.

Training must be repeated regularly. Regulation requirements evolve, and software revisions bring new functionality. Hold regular refresher courses to keep the team current and confident in their ability.

Automation is considered a support rather than a replacement for human functions. Highlight how automation reduces monotonous work. Furthermore, it allows people to spend more time on things that create value, require judgment, and are expert-based. Virtual employees are engaged in the compliance process, maximizing the use of automation with the right training. This not only makes compliance robust but also boosts productivity and employee satisfaction.

Also Read: Marketing Data Analysts and Creative Teams

Watch and Refine Compliance Automation Processes

Compliance automation does not work on a “set it and forget it” approach. Small businesses must periodically evaluate them and make the required modifications when laws or business needs change for automated processes to continue to be effective.

To keep your automation valid and effective, pay attention to:

- Regularly reviewing reports: Utilize dashboards on your system to monitor important metrics like pending deadlines, open compliance issues, or missed notifications.

- Keeping system rules up to date on time: Update automation workflows in line with the new standards instantly for laws or sectoral regulations are amended.

- Regular audits: Even automated workflows need to be audited for accuracy. Manual audits ensure errors are caught and workflows refined.

- Calculating ROI: Monitor time saved, error reduction, and audit since going live with automation.

Monitoring helps you figure out all issues beforehand. To illustrate, a small manufacturing business may look at safety compliance reports every month, catching missing training records before an inspection takes place.

Changes also come as your business expands. Expanding into new markets, introducing new services, or adding more employees may create new compliance obligations. You keep your automation in line with your business reality by continuously streamlining your procedures.

Active monitoring not only ensures compliance but also gets the most out of your automation investment. As long as systems are regularly optimized, they become part of a compliant strategy for the long term.

Merging Compliance Automation with Existing Business Systems

Compliance automation must seamlessly interact with the systems your small business presently uses in order to deliver the most value. Storage barriers are broken down, manual intervention is reduced, and duplicate effort is eliminated when automation is integrated into HR, payroll, accounting, and CRM systems.

To integrate compliance automation effectively with current systems, small businesses must:

- Evaluate existing technology: Determine which platforms contain compliance-related information, i.e., employee information in HR platforms, transactional information in accounting software, or customer information in CRM systems.

- Select automation tools with integration capabilities: Seek compliance systems that provide integrated connectors or API support for seamless data exchange.

- Support data synchronization: Establish automatic syncing for changes can be reflected immediately across all connected platforms.

- Pilot test prior to complete rollout: Pilot integrations ensure proper functioning of workflows and synchronized data.

Integration smooths out processes by linking compliance demands directly with everyday procedures. For instance, an HR platform integrated with compliance automation will track completions of employee training automatically and update compliance dashboards manually. In the same way, integration with accounting software would make tax compliance report preparation automatic, saving hours of data collection.

In addition to efficiency, integration also minimizes risk. When systems can exchange information, there is less opportunity for mistakes due to stale or conflicting data. Bad data results in a fine or loss of reputation for heavily regulated markets.

By prioritizing integration, small businesses can establish an interconnected ecosystem in which compliance is not an added task but an inherent part of all business operations. This minimizes errors, reduces time, and keeps compliance up to date without increasing the workload.

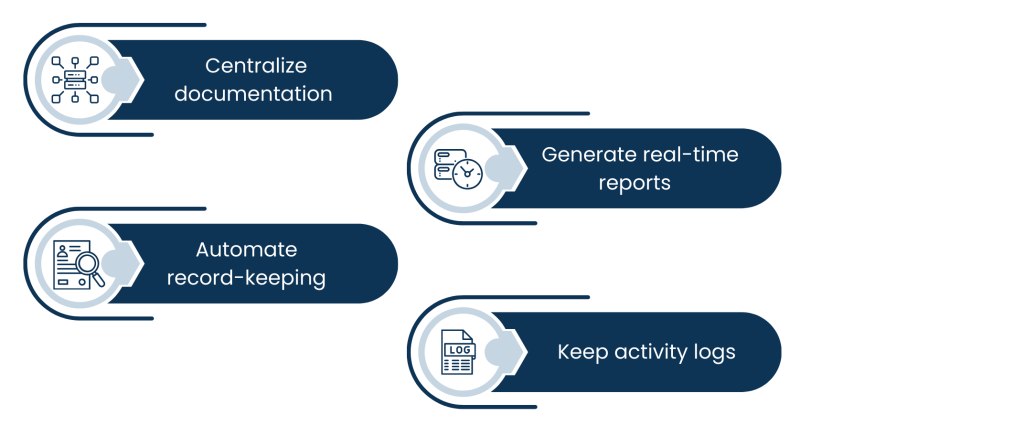

Using Compliance Automation to Prepare Audit

Audits are stressful for small business owners. Particularly when records are spread across disparate systems or stored manually or with alternatives for VA. Automation of compliance turns this on its head by bringing records together, tracking activity, and providing reports that make audit prep much easier.

To utilize Compliance Automation to become audit-ready, companies should:

- Centralize documentation: Hold all compliance documents in a secure, searchable repository.

- Automate record-keeping: Make systems record policy changes, training completion, and significant compliance activities automatically.

- Generate real-time reports: Utilize automation to produce immediate snapshots of compliance status, imminent deadlines, and requirements completed.

- Keep activity logs: Have complete, dated records of who performed every compliance action and when.

These features not only offer time savings but also transparency and responsibility to auditors. For instance, if a certifying body needs proof of employee certifications, automation can provide a report in minutes, showing training dates, completion rates, and outstanding requirements.

Continuous reports and reminders guarantee the timely fixation of all errors before an audit. This proactive step ensures a successful audit.

Small businesses are sure they can comply accurately and quickly with audit readiness compliance automation. Moreover, it not only protects them from fines but also builds trust with authorities, clients, and stakeholders.

Conclusion

Compliance Automation does not always require expensive, high-tech equipment or overworked employees. Rather, it is an economical way to keep up with regulations, reduce mistakes, and be prepared for audits without using up valuable resources.

By focusing on your highest-risk compliance areas, investing in scalable but reasonably priced technologies, appropriately training your staff, and monitoring progress over time, you can develop a compliant program that can expand with your business.

Automation saves you time without any chaos. Trusting the process of critical operations like document tracking, policy changes, and reporting gives you the ability to run and grow your business.

In our rapidly evolving regulatory landscape, the companies that succeed are those that remain ahead of the curve. Automation of compliance is no longer a big-firm luxury—it’s a necessary utility that small firms can and ought to harness for long-term success.

With Tasks Expert services, even small businesses may attain the same level of precision and efficiency as giant corporations thanks to the availability and affordability of modern compliance automation solutions.

About Us

Tasks Expert offers top-tier virtual assistant services from highly skilled professionals based in India. Our VAs handle a wide range of tasks, from part time personal assistant to specialized services like remote it support services, professional bookkeeping service etc. Furthermore, it helps businesses worldwide streamline operations and boost productivity.

Ready to elevate your business? Book a Call and let Tasks Expert take care of the rest.