Introduction

One of the most important steps to take after starting up your venture is proper finance management so that the company survives. Any new business’ bookkeeping ensures that all records are original, accurate, and up-to-date and is necessary for all those pre-growth plans and checks for compliance and meaningful decision-making.

1. Why is Bookkeeping Important Among Startups?

Bookkeeping includes all business transactions, such as payroll, taxes, costs, and income. Good bookkeeping for startups is essential to their expansion and financial stability more than merely maintaining compliance.

The key reasons bookkeeping is integral for startups:

- Financial Clarity: With proper bookkeeping, you will have clarity of your cash flow, profitability, and financial position.

- Tax Compliance: All the records will ensure the right tax obligations are met and assistance is claimed on deductions or credits.

- Investor-readiness: Organized finances make it easier to attract investors because the startup comes out as financially healthy.

- Informed Decision-Making: Utilizing your updated records and real-time insights allows you to make informed decisions.

- Scalability: A solid core bookkeeping will facilitate scalability as your business expands.

Startups can avoid financial pitfalls by prioritizing bookkeeping for success.

2. Basic Bookkeeping Practices for Startups

For a startup to maintain financial organization and compliance, it should adopt these basic bookkeeping practices. Here’s a checklist of what every startup should implement:

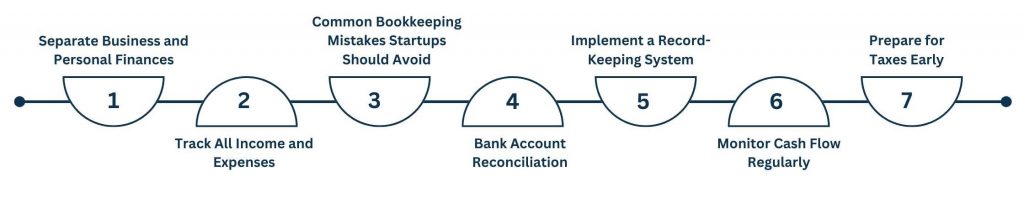

Basic bookkeeping practices:

Separate Business and Personal Finances:

- Description: Open a dedicated business bank account and use it exclusively for business transactions.

- Benefits: Prevents confusion during tax season and ensures a clear record of business expenses.

- Tips: Use a business credit card for all startup-related purchases to keep transactions traceable.

Track All Income and Expenses:

- Description: Record every financial transaction, including sales, investments, operational costs, and utility bills.

- Benefits: Ensures accurate financial statements and prepares your business for audits.

- Tips: Use accounting software to make transaction tracking and classification more automatic.

Common Bookkeeping Mistakes Startups Should Avoid:

- Description: Startups usually have a hard time handling finances to avoid wasting a lot of their time and money.

- Benefits: Enhance easier and more accurate report levels of financial statements.

- Tips: Personalize your chart of accounts to suit the needs of your startup.

Bank Account Reconciliation:

- Description: Sort receipts, invoice documents, and other papers in an organized manner.

- Benefits: It makes tax filing easier and ensures compliance with regulatory requirements.

- Tips: Reconcile accounts every month to maintain accurate financial statements.

Implement a Record-Keeping System:

- Description: File receipts, invoices, and other papers about finance for easier access.

- Benefits: It simplifies tax filing and ensures compliance with regulatory requirements.

- Tips: Digitize and organize records by using cloud storage or bookkeeping software.

Monitor Cash Flow Regularly:

- Description: Keep track of money coming in and going out to ensure your business remains solvent.

- Benefits: Helps anticipate cash shortages and manage operational expenses effectively.

- Tips: Review cash flow statements weekly or monthly to stay informed.

Prepare for Taxes Early:

- Description: Estimate your tax obligations and set aside funds to avoid surprises.

- Benefits: Reduces stress and ensures timely tax payments.

- Tips: Work with a tax professional to understand deductions and credits applicable to startups.

By following these practices, startups can maintain financial accuracy and keep ready to grow.

Also Read: Virtual Assistant Services in Isle of Man

3. Common Bookkeeping Mistakes Startups Should Avoid

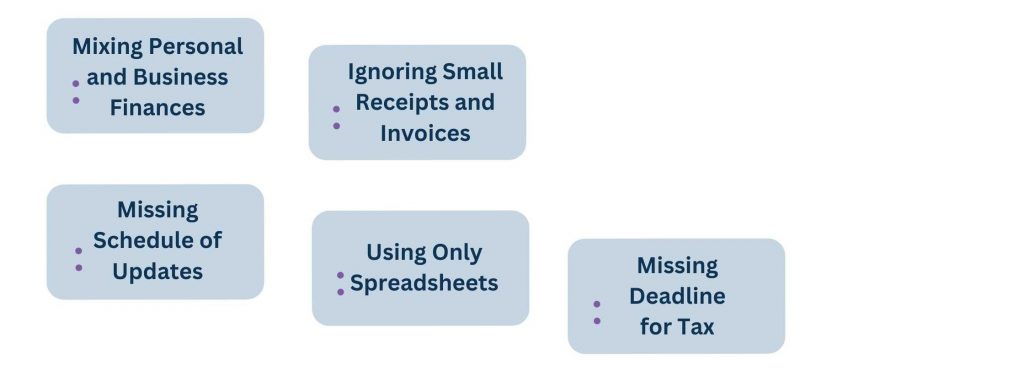

Start-ups struggle to handle finance in order to save time and money. Here are some common mistakes one needs to be warned about:

Bookkeeping mistakes to avoid:

- Mixing Personal and Business Finances: This creates confusion and becomes complicated while filing taxes.

- Missing Schedule of Updates: Lack of updating the records regularly may result in errors as well as missing deadlines.

- Ignoring Small Receipts and Invoices: Failure to track small purchases usually means financial reports will not be accurate.

- Using Only Spreadsheets: Using spreadsheets is good, but it is not as automated and not as accurate as bookkeeping software.

- Missing Deadline for Tax: Missing tax deadlines might put businesses to penalties and loss of reputation.

Avoiding these ensures smoother financial operations and fewer risks for your startup.

4. Tools and Software for Bookkeeping of a Startup

Startups should make use of modern bookkeeping tools and software to reduce the complexity of bookkeeping tasks and enhance accuracy. Here are some of the popular ones:

Recommended bookkeeping tools:

- QuickBooks: All-inclusive accounting software to monitor earnings, costs, and payroll.

- Wave: A free bookkeeping software appropriate for small startup businesses that have simple needs.

- Xero: Cloud-based software that offers invoicing, expense tracking, and financial reporting features.

- FreshBooks: Invoicing, time tracking, and expense management-friendly software.

- Zoho Books: An affordable, accounts payable software related to rich small business features.

These tools provide real-time understanding, and save the precious time of the founder making bookkeeping easier.

5. Benefits of Outsourced Bookkeeping for Start-ups

Outsourcing adds meaningful value since some start-ups choose in-house bookkeeping. There are several advantages that an emerging business accrues from its scarce resources.

Benefits of bookkeeping outsourcing:

- Experience: Professional bookkeepers possess ample experience and depth of knowledge to handle complicated financial operations.

- Time Efficiency: It enables you to redirect time to your core business activities rather than purely administrative tasks.

- Economical: Hiring a virtual bookkeeper instead of a full-time employee is usually economical.

- Scalable: Expanding services can be easily adapted according to the changes in your business as it expands.

- Accuracy and Compliance: Professionals ensure that records are accurate and compliant with tax regulations.

For startups wanting to really streamline their operations and have financial health, outsourcing bookkeeping is a good option.

Also Read: Virtual Assistant Services in Ballasalla

6. When to Seek Professional Help

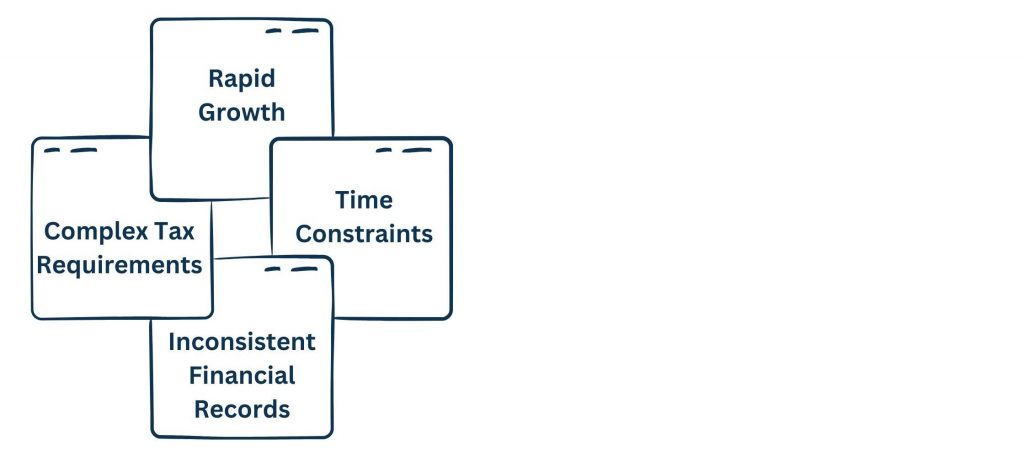

Startups should consider seeking professional help when they face any of the following challenges:

- Rapid Growth: Managing high levels of financial transactions becomes overwhelming.

- Complex Tax Requirements: Any complex issues of tax laws start being difficult to understand and comply with.

- Inconsistent Financial Records: Errors in bookkeeping lead to inaccurate reports or missed deadlines.

- Time Constraints: Balancing bookkeeping with other responsibilities limits productivity.

By working with a qualified bookkeeper or accounting firm, you can be comfortable that your money is in good hands and concentrate on growing your startup.

Conclusion

Effective bookkeeping for a startup is the key to being healthy financially, in compliance, and supporting sustainable growth. By implementing best practices, and modern tools, and avoiding common mistakes, a great financial foundation for your startup can be established. While many opt to continue it in-house, outsource, or a combination of both, maintaining organization and proactivity with finance is what brings success.

If your startup is ready to cut out the mess of bookkeeping and move ahead toward growth, consider professional bookkeeping services to ensure accurate records and financial clarity.

About Us

Tasks Expert offers top-tier virtual assistant services from highly skilled professionals based in India. Our VAs handle a wide range of tasks, from part time personal assistant to specialized services like remote it support services, professional bookkeeping service etc. Furthermore, it helps businesses worldwide streamline operations and boost productivity.

Ready to elevate your business? Book a Call and let Tasks Expert take care of the rest.