Introduction

Every big goal can be achieved with small, smart steps. However, smart money moves are crucial for small businesses, where every dollar comes at a high personal cost. That’s why small business owners who can’t afford top fintech talent should leave their finances to the pros. Read on and discover the never-advertised challenges behind small business accounting!

Behind a confident business is smart financial management. Although every business starts with a unique idea or a new approach, it’s not just passion that pays the rent or keeps the server running. However, most business owners and fellow entrepreneurs quickly see which way the money winds. From sustainable growth to hopeful survival, no goal seems clear without the stable foundation of a break-even statement.

While accounting may look as geeky and boring as it comes, the smartest businesses spend more on analysis than on fancy dinners for the team. Below is a shortlist of the things that most small business owners struggle with.

Common small business owner accounting mistakes and struggles

Let’s be honest — small business owners often wear too many hats. You might be the CEO, marketer, HR, and accountant all in one day. But that approach comes at a cost.

Common financial struggles include:

- Inconsistent bookkeeping or filing.

- Poor cash flow management.

- Additional penalties.

- Loss of investor confidence.

Moreover, these challenges are not just stress factors; they can lead to additional limitations. Accounting services address these issues by implementing systems that are reliable, timely, and transparent.

Also Read: Data Feed Management

How Accounting Services Empower Small Businesses?

Good accounting is not just a matter of compliance, but of control. With accurate financial information, you can be a lot more effective at both spotting opportunities and avoiding risks.

1. Clarity and Confidence in Decision-Making

You can have a better sense of how money is being spent, which means you can make better decisions — about staffing or marketing. Accountants not only have a cool report to look at monthly metrics and gauges for growth, but they also tweak the dial or strategy.

2. Saving Time and Reducing Stress

Entrepreneurs already juggle enough responsibilities. By outsourcing accounting, they can focus on making sales, providing an excellent product and experience — not paperwork.

3. Staying Legally Compliant

It’s difficult to have uniform expectations when, from GST filling in India to the IRS in the US, small business have laws and tax laws very far apart. For the most secure approach to filing your taxes, a professional accountant can ensure that you’re filing accurately and don’t make costly errors.

4. Managing Cash Flow Effectively

For small businesses, cash flow is the lifeblood. Accountants forecast future income and expenses so you can plan for slow times or reinvest profits.

5. Long-Term Growth Support

Beyond being bookkeepers, accountants are growth partners. They help with budgeting, KPI monitoring and cost/margin reduction.

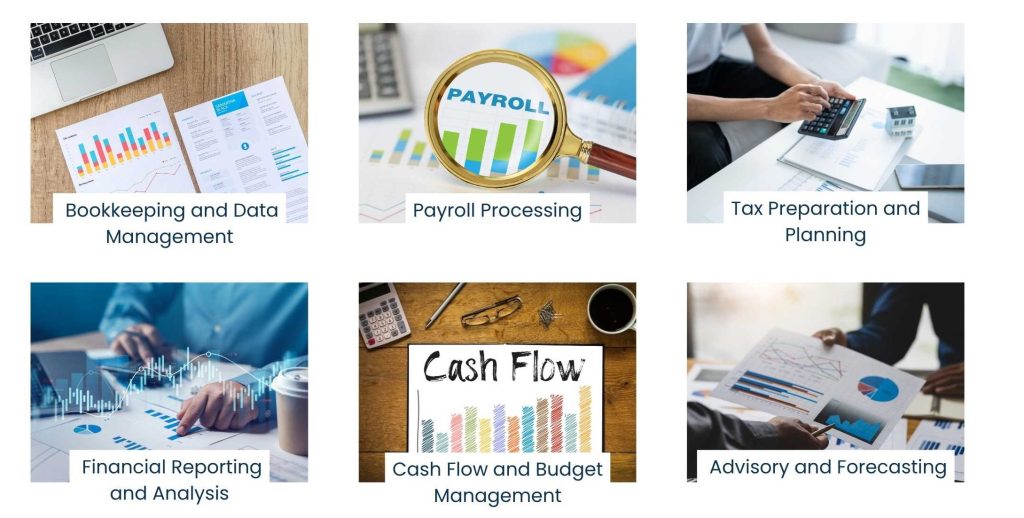

Essential Accounting Services for Every Small Business

Depending on the circumstances and stage, some accounting services are more required than others.

However, there is a set of services without which no financially competent business is possible:

1. Bookkeeping and Data Management

- Full-fledged bookkeeping and “home” record keeping.

- Confirms and supervises the financial condition.

- Features guidelines and model policies to spread, track, and prove economic news.

If the management of financial duties has become a burden, consider outsourcing to a virtual bookkeeping assistant that maintains accurate records at an affordable expense.

2. Payroll Processing

- Accurate and timely employee remuneration.

- Includes deductions and tax compliance.

You can also have the HR virtual assistant services to help ensure adherence and on-time payments, which go from salary slips to tax deductions.

3. Tax Preparation and Planning

- Maintain a good record of paying quarterly assessments and year-end returns.

- Find out what ways are real to spend less.

4. Financial Reporting and Analysis

- Monthly and quarterly reports for insight into company finances

For growing businesses, combining reporting with insights from a data entry virtual assistant ensures every number is tracked, verified, and analyzed accurately.

5. Cash Flow and Budget Management

- Monitor cash inflow and outflow to prevent a financing crisis.

- Ensure liquidity.

6. Advisory and Forecasting

- Accountants act as part-time C.F.O.

- Guide funding, expansion, and growth.

Also Read: Web Analytics Consultants

The True Value: Why Outsourcing Accounting is a Game-Changer

Hiring a full-time accountant might be insufficient for a small company. Outsourcing is a favorable substitute.

Outsourcing accounting advantages:

- On-demand expertise: Certified experts without hiring full-time staff.

- Precision-driven technology: Cloud-based tools like QuickBooks, Zoho Books, or Xero.

- Lower operational costs: Pay only for the services needed.

- Global access: Manage finances anywhere, anytime.

- Business continuity: Maintain updates despite leaves or turnover.

Before and After: Smart Accounting in Action

Before:

- A tiny digital marketing business used manual spreadsheets.

- Invoices were lost.

- Accounts are unsettled and payments are overdue.

- Weekly financial data showed the company was losing money.

After:

- Virtual accounting assistant via Tasks Expert.

- Cloud bookkeeping to automate invoicing and generate monthly summaries.

- Improved cash flow within months.

- Tax evaluation for co-founders.

Result: Not just neat books, but increased company traction.

If you’re unsure which accounting tasks to prioritize, explore how a financial virtual assistant can streamline multiple functions under expert supervision.

Technology’s Function in Modern Accounting

- QuickBooks: Auto-recording bookkeeping.

- Zoho Books: Automation and CRM integration.

- Xero: Good for startups with multiple currencies.

- FreshBooks: Ideal for freelancers and service providers.

Automation allows accountants to focus on advisory roles rather than manual bookkeeping.

When is the Best Moment for a Small Business to Engage Accounting?

Signs that it’s time to hire accounting support:

- Business earnings keep growing.

- Reconciling accounts and tracking bills becomes difficult.

- Taxes are causing unexpected stress.

- You need business investors.

- You require financial clarity.

Early professional accounting ensures structured growth, not chaos.

Conclusion

Professional accounting services for small businesses enhance control over finances. From daily bookkeeping to strategic advisory, accountants are not just number crunchers; they are partners and profit strategists.

Tasks Expert provides reliable accounting and virtual assistant services to maintain financial health. Visit our services page or explore our industries page to see how your business can benefit.

Frequently Asked Questions

Include bookkeeping, payroll, tax management, cash flow tracking, financial reporting, and small business-tailored processes.

Deliver financial visibility, drive alignment with company norms and standards, inform decision-making, and assist in reporting and analysis.

Customizable+discounted flexible pricing, more affordable than hiring internally.

QuickBooks, Xero, Zoho Books – they all ensure automation as well as accuracy and reporting.

Yes, including preparation, filing, and tax advisory.

About Us

Tasks Expert offers top-tier virtual assistant services from highly skilled professionals based in India. Our VAs handle a wide range of tasks, from part time personal assistant to specialized services like remote it support services, professional bookkeeping service etc. Furthermore, it helps businesses worldwide streamline operations and boost productivity.

Ready to elevate your business? Book a Call and let Tasks Expert take care of the rest.