Introduction

As businesses expand, managing finances often transforms into an overwhelming task. Accurate bookkeeping is not merely a clerical duty but the backbone of informed and lawful decision-making, for sustained success. This is why numerous businesses hire a bookkeeper, to take on the burden of complex monetary operations, maintain records, and bring peace of mind.

In this article, we decode the deep advantages of hiring a bookkeeper, delve into their main responsibilities, and guide you in selecting the best-suited bookkeeper for your business.

Why is a Bookkeeper Essential?

A bookkeeper organizes financial data such as sales, expenses, and payroll. Hiring an expert bookkeeper brings various benefits for every business like time savings and reduced errors while maintaining law standards.

Core Reasons to Hire a Bookkeeper:

Save Your Time: This means that keeping financial records will free you from monotonous paperwork to focus on growth-oriented tasks.

Improved Accuracy: Bookkeepers are well-experienced in keeping accurate and up-to-date records, so costly mistakes are never made.

Compliance with Regulations: A professional bookkeeper ensures that your business is aligned perfectly with tax laws and financial guidelines by eliminating legal risks.

Informed Decisions: Well-maintained financial reports ensure a complete view of your business health, supporting strategic planning and forecasting.

Scalability Made Easy: As your business grows, financial complexities grow too. A professional bookkeeper adapts to this progress, handles complex accounts, and enables you to scale.

Investing in a professional bookkeeper is not an expense, but a strategic move toward fortifying your business’s financial stability and ensuring that you have sustained success.

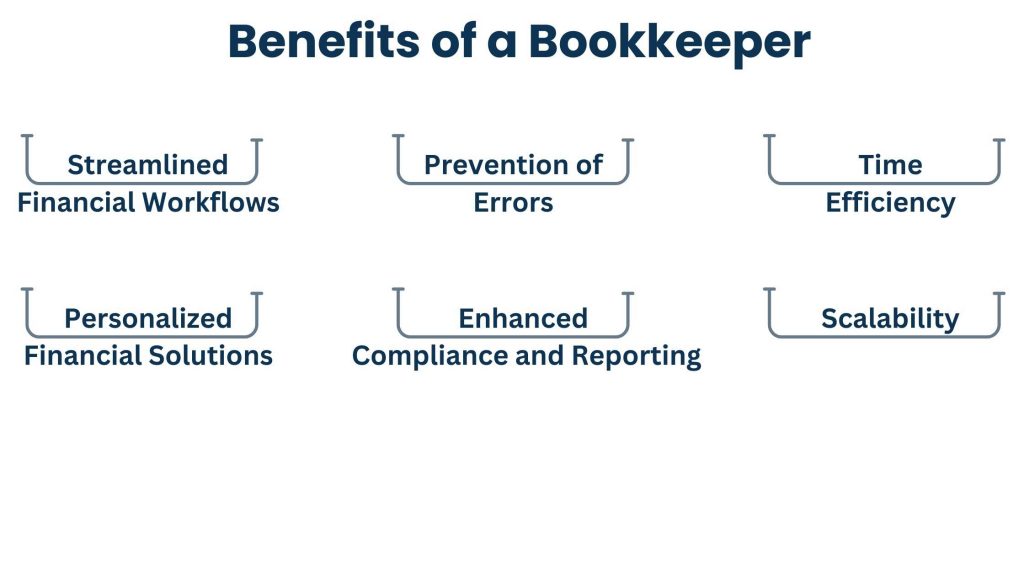

Benefits of a Bookkeeper

The value that comes with having an experienced bookkeeper is unmeasurable.

Here’s why:

Streamlined Financial Workflows: A bookkeeper controls critical tasks such as creating invoices, sending bills, and reuniting bank accounts. Therefore, they increase efficiency and minimize inconsistencies.

Prevention of Errors: Detail-oriented bookkeepers protect your records from errors and keep every document accurate on the roll call sheet.

Time Efficiency: By handling complex finances, a bookkeeper gives you ample time to innovate and expand your business, thus moving it forward.

Personalized Financial Solutions: Bookkeepers will develop accounting strategies that align with your business’s goals and mission, bringing you a clear direction whether you are facing growth or challenges.

Enhanced Compliance and Reporting: Tax compliance and regulatory reporting are the lifeline of any business. A good bookkeeper keeps all these obligations in check, so there are no unwelcome surprises during audits or tax season.

Scalability: As your business grows, a bookkeeper can adapt to increased financial complexity, providing scalable support for your needs.

This helps ensure that financial operations are smooth and minimizes administrative burdens.

Also Read: Virtual Assistant Services in Limerick

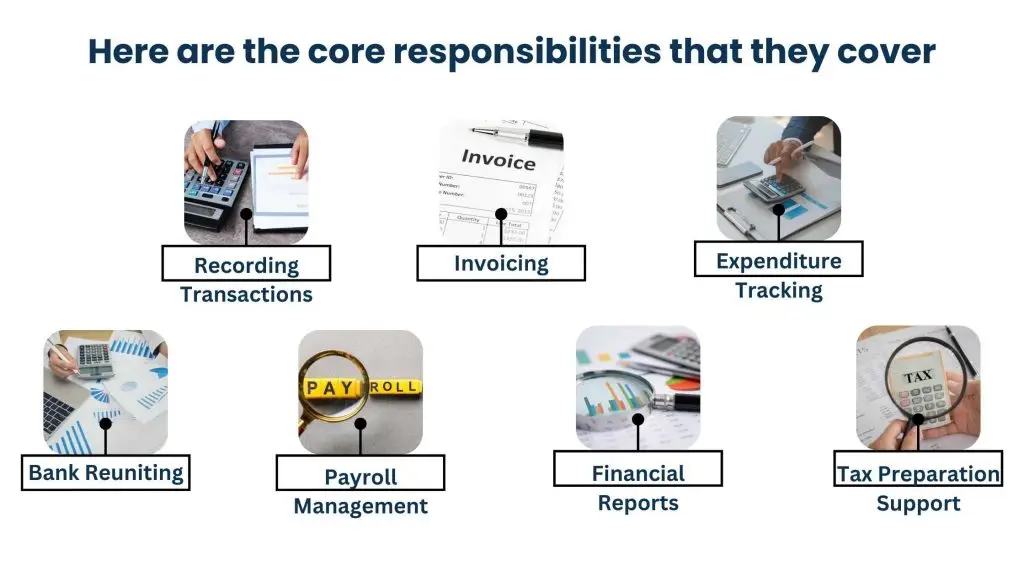

What a Bookkeeper Does?

Bookkeepers do various tasks related to financial operations that govern the smooth running of business.

Here are the core responsibilities that they cover:

- Recording Transactions: The daily transaction recording through accounting software.

- Invoicing: Create and send invoices to customers

- Expenditure Tracking: Accurate expense tracking and categorizing.

- Bank Reuniting: Adjust the financial records according to those of the bank statement.

- Payroll Management: Employment wage computation, deductions, final payroll processing

- Financial Reports: Accurate financial reports for decision-making

- Tax Preparation Support: Document preparation and consultation with accountants before filing taxes.

Hire a bookkeeper to keep your business running smoothly and in financial order.

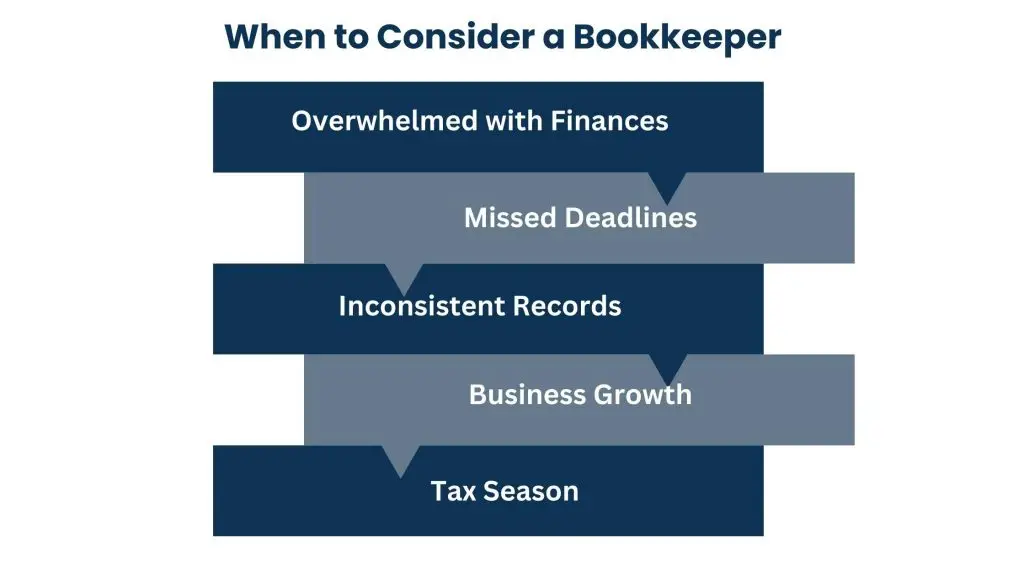

When to Consider a Bookkeeper

Following are the signals that tell you that it’s time to hire a bookkeeper:

- Overwhelmed with Finances: You are stuck in managing finances and cannot focus on core business activities.

- Missed Deadlines: Late payments or missed tax deadlines are occurring.

- Inconsistent Records: Financial errors are causing problems.

- Business Growth: Your business is scaling, and financial transactions are becoming more complex.

- Tax Season: Unorganized records and filing taxes is overwhelming.

If notice any of these signs, then consider hiring a bookkeeper to reduce your stress and improve your financial management.

Choose the Right Bookkeeper

The right bookkeeper is important for your business’s success.

Here are some qualities to consider in a bookkeeper:

Experience:

- Look for an experienced bookkeeper proficient in relevant accounting software.

- Prefer a Certified Bookkeeper.

Good Communication Skills:

- Hire a bookkeeper who speaks well, and keeps you posted on all financial matters.

Attention to Detail:

- A good bookkeeper must have sharp eyesight for observation, ensuring accurate records and compliance.

References and Reviews:

- References or reviews will give you an insight into the bookkeeper’s reliability and work quality.

Technical Savvy:

- The bookkeeper should be skilled in the latest tools and software.

- The bookkeeper should be skilled in the latest tools and software.

Flexibility:

- Bookkeepers should be flexible enough to adapt to your business needs and offer support accordingly.

Review these factors, and you can hire a suitable bookkeeper.

Also Read: Virtual Assistant Services in Navan

Outsourced or permanent staff

The Pros and Cons of In-house or Outsourced Bookkeeping are:

1. In-House Bookkeeping staff:

Pros:

- Direct access to the bookkeeper.

- Tailored to your business needs.

Cons:

- Higher costs due to salaries and benefits.

- Limited scalability.

2. Outsourced Bookkeeping:

Pros:

- Cost-effective and scalable.

- Access to a team of experts with diverse skills.

Cons:

- May lack the immediacy of in-house staff.

For businesses, outsourcing bookkeeping offers better flexibility and reduced costs.

Conclusion

A professional bookkeeper handles financial tasks with compliance. Hire a bookkeeper permanently or outsource the role, you’ll benefit from improved financial organization and better decision-making.

Consult Tasks Expert to streamline your financial processes. They will hire a bookkeeper to manage your financial health.

About Us

Tasks Expert offers top-tier virtual assistant services from highly skilled professionals based in India. Our VAs handle a wide range of tasks, from part time personal assistant to specialized services like remote it support services, professional bookkeeping service etc. Furthermore, it helps businesses worldwide streamline operations and boost productivity.

Ready to elevate your business? Book a Call and let Tasks Expert take care of the rest.