Introduction

E-commerce business on Shopify is not all about selling goods. The growth and sustainability depend on proper finance management. Shopify bookkeeping organizes financial records to make informed decisions while complying with tax regulations.

This blog explores the importance of Shopify bookkeeping and the major tasks and tools involved in accounting for an e-commerce business, that make financial management smooth.

Interpreting Shopify Bookkeeping

Shopify accounting covers all the transactions on your site like sales and returns, shipping and inventory costs, tax and regulatory requirements, and other related activities.

Major Activities under Shopify Bookkeeping:

- Daily Sales and Returns.

- Reconciliation of Payment Gateway including Stripe and PayPal.

- Shipping expense tracking and Inventory Costs.

- Management of Taxes and Regulations.

- Preparing Financial Statements.

Significance of Shopify Bookkeeping

- Financial Accuracy: Provides precise statements on revenues, and expenses.

- Tax Compliance: Ensure complaint records to avoid penalties.

- Informed Decision-Making: Utilize financial data for budgeting and optimizing operations.

- Improved Cash Flow: Monitoring funds to maintain liquidity.

- Scalability: Adjust services according to your specific business needs.

Major Tasks of Shopify Bookkeeping

- Sales Tracking: Sales, refunds, and discounts through Shopify report.

- Expense Management: Operating expenses, advertising, shipping, and supplies.

- Payment Reconciliation: Agreement of payment gateway transactions with bank statements for accuracy purposes.

- Tax Preparation: Calculating and saving sales tax depending on your location and customers.

- Inventory Maintenance: Tracking purchasing, storing, and shipping products.

- Reporting: Creating balance sheets and profit-and-loss statements.

Also Read: Senior Living Marketing

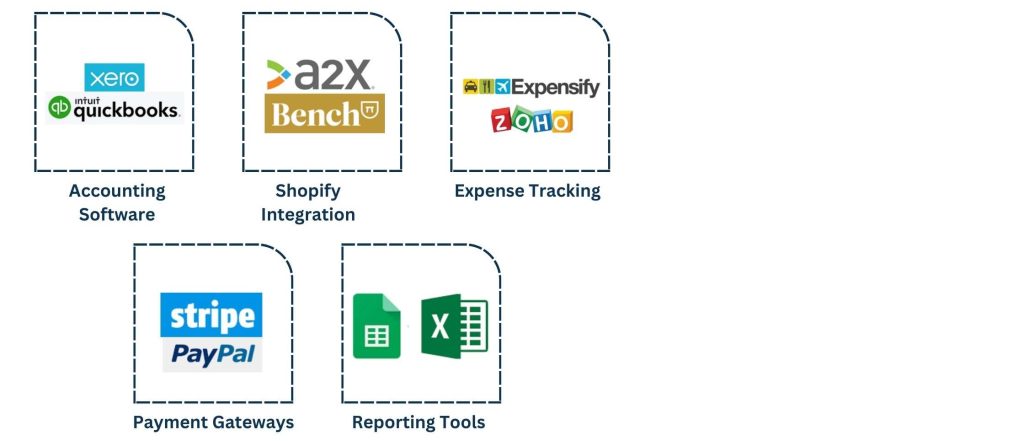

Shopify Bookkeeping Tools

Shopify accounting becomes effortless with the appropriate tools and software:

- Accounting Software: QuickBooks, Xero.

- Shopify Integrations: A2X, Bench.

- Expense Tracking: Expensify, Zoho.

- Payment Gateways: PayPal, Stripe.

- Reporting Tools: Google Sheets, Excel.

Advantages of Outsourcing Shopify Bookkeeping

- Saves Time: Spend time on business development while experts complete the bookkeeping tasks.

- Accuracy: Reduce errors through experienced bookkeepers who are conversant with Shopify.

- Adherence: Pay no mind to tax laws, and reporting rules without stress.

- Scale: Ensure your bookkeeping procedure can handle your increased sales based on the growing nature of the business.

- Expert knowledge: Get advisories and reports to help boost financial performance.

Challenges in Shopify Bookkeeping

- Reconciliation of a Payment Gateway: Multiple gateways may complex the transactions.

- Tax variability: Sales customs differ by region and must be considered.

- Inventory Costs: Accurate billing and adjustments must be recorded for correct financial management.

- High Volume Transactions: Large sales volumes make bookkeeping cumbersome and vulnerable to errors.

Conclusion

Effective Shopify bookkeeping is a key component of a thriving online store. Accurate financial records stick to regulations and facilitate strategic business choices. Whether you manage accounting internally or delegate it to experts, tracking your finances is crucial for sustained growth.

Invest in resources and services designed to address the unique financial requirements to enhance and simplify your operations. Concentrate on developing your online store through systematic and effective accounting. Contact Tasks Expert today.

About Us

Tasks Expert offers top-tier virtual assistant services from highly skilled professionals based in India. Our VAs handle a wide range of tasks, from part time personal assistant to specialized services like remote it support services, professional bookkeeping service etc. Furthermore, it helps businesses worldwide streamline operations and boost productivity.

Ready to elevate your business? Book a Call and let Tasks Expert take care of the rest.