Introduction

Back Office Outsourcing for insurance, scaling a company is not just about writing more policies; it’s about managing the operational strain with expansion. From policy administration and claims processing to data entry and compliance, back-office tasks significantly burden in-house teams and impede progress.

This is why many progressive insurance agencies are looking to outsource insurance back-office work. It’s an economical way to increase volume, preserve accuracy, and allow staff to spend time on client-focused, money-making efforts.

In this blog, I will explore how back office outsourcing supports growth, the primary functions. That lends itself to delegation, and it’s an intelligent play for modern insurance businesses looking to scale sustainably.

What Is Insurance Back Office Outsourcing?

Insurance back office outsourcing means hiring an external professional or virtual assistant to take care of the non-client-facing administrative work. That underpins your operations, however, it is time-consuming and tedious. These functions underpin your agency’s workflow, accuracy, and client satisfaction, but they don’t require hands-on customer interaction.

Delegating these tasks frees up internal resources. And also allows you the flexibility to concentrate on business development and managing customer relationships.

Here’s a breakdown of the most common Back Office Outsourcing functions you can outsource:

🧾 Issuance and Renewals of Policies

Outsourced teams can navigate the entire process from preparation to review and issuance of policy documents. They also handle renewal notices, monitor updates, and ensure that deliverables reach clients on time — reducing lapses and improving retention. They also track expiration dates, and deadlines and send reminders—keeping policies in force and compliant. It allows your internal team to focus on upselling and cross-selling the client instead of chasing paperwork.

📋 Claims Processing and Documentation

From logging claims to collating supporting documents and updating claim statuses, outsourced support makes sure that your claims process is timely and substantiated. This helps cut down turnaround time and ensures that clients are kept in the loop. They also identify inconsistencies, verify that claims are sufficiently complete, and escalate urgent cases promptly. When done properly, they foster faster settlements and fewer disputes over claims, better serving customers and allowing for potentially higher retention rates.

✅ Compliance Monitoring

Your outsourcing partner will help keep your practice compliant by monitoring changes to regulations, verifying documentation as required, and maintaining audit-ready records. This minimizes risk and guarantees consistent compliance with industry standards. They also generate compliance checklists, indicate missing elements, and assist in implementing standard operating procedures across your teams. An outsourced compliance process ensures your business is less vulnerable to penalties, audits, or client disputes for incomplete or incorrect recordkeeping.

📊 Updating and managing records

Insurance requires precise execution of data entry. Back office support ensures the information about clients, policies, and claims is entered into your CRM or AMS correctly. The data gets inputted automatically, which means that no human error could result from a manual operation, and hundreds of facets of admin work are saved by relying on a virtual assistant. VAs can also keep data clean, eliminate duplicates, and sort records by category or policy status. That ensures internal systems are stable, updated, and fully prepared to be audited in case of compliance review, reporting, or performance tracking.

💰 Invoicing and – Commission Tracking

Your internal staff knows about its projects, while on the field, agents are taking up multiple projects here and there. Outsourced teams can generate invoices, reconcile payments, and track agent commissions, offering a lens of clarity and accountability for both factors. They can also automate reminders for late invoices, match payments to policies, and create monthly commission reports. Not only does this cut accounting errors, but it also fosters trust with agents by guaranteeing they’re paid correctly and on time — all while keeping your revenue cycle seamless and above board.

📩 Email and Document Management

A VA or some back office assistant can triage your incoming emails, prioritize tasks, and manage document uploads or archiving — giving your digital workspace a clean setting. They can also generate templated responses, redirect important messages to relevant team members, and keep organized folders by client, policy type, or department. That way you won’t have any missed communications, and turnaround times are expedited, allowing your team to stay efficient and your clients to always feel supported.

📂 Underwriting Support

Support personnel can help underwriters collect risk information, prepare drafts, and validate documentation, which speeds up approvals and improves the quality of applications. They can also chase up brokers or clients for missing information, flag incomplete applications, and produce comparison tables for listing applications. Having these tasks managed efficiently allows underwriters to concentrate on high-value decision-making, increasing throughput without compromising quality or compliance standards

Also Read: Virtual Assistant Services in Museum

Why Insurance Businesses Fail to Scale In-House

Growth does bring growing pains — particularly when internal resources are stretched thin. The more clients and policies you onboard, the more complex your operations become. A process that works for a small team can become a mess at scale. Overburdened staff, deteriorating customer service quality, and stagnating business performance can be the precarious consequences of a lack of structured systems and scalable support. Insurance companies are often forced into optimizing whilst moving quickly so understanding the key operational challenges that arise during periods of high growth will help maintain momentum.

These challenges include:

🛑 High Administrative Load

More paperwork as your book of business grows. Renewals, record updates, and claims management are all valuable hours that could be spent building rapport or cross-selling policies. Data can quickly become unwieldy, especially if you work with multiple carriers, coverage types, and customer segments. Without streamlined processes and support, tasks go undone, errors increase, and your team spends most of its time reacting rather than proactively serving clients or growing your portfolio.

⏱️ Delayed Turnaround Times

When internal teams are strained, even mundane tasks like issuing certificates or responding to queries can take days. This delay has a direct impact on client satisfaction and revenue cycle acceleration. Everyone is unhappy with slow service, from clients to agents to partners, and it leads to lost opportunities or lost renewals. Delays hurt your credibility, too, given that in many markets, you need to be the first and fastest while being hands-on. These bottlenecks can hinder growth and tarnish your agency’s reputation over time.

💸 Rising Operational Costs

Back office roles, in particular, become costly in terms of hiring, training, and retaining in-house staff. Between payroll, benefits, workspace expenses, and technology, operational costs can add up quickly. And when turnover does occur, you lose time—time to recruit a replacement, time for that new person to learn the ropes, and institutional knowledge. Plus, when your business grows, bringing on more staff doesn’t always translate to increased efficiency, particularly if there are no systems in place for them to get to work. In fact, without scalable solutions, growth can be costly and unsustainable long term.

📉 Absence of Dedicated Support

However, many in-house teams take on multiple functions. That all-consuming back office action means that accuracy and compliance can go astray, putting your firm at risk of regulatory issues or ultimately not satisfying clients. Specific back-office-related tasks such as compliance tracking, claims processing, and policy audits require focused expertise. Your company becomes prone to miss important updates, data entry errors, and documentation process deviations when your team is stretched thin, further exposing you to risk and preventing service landmarks from being met.

Advantages of Back Office Outsourcing For Insurance

Outsourcing your back office is about more than cost savings—when done right, it unlocks sustainable growth and better service delivery.

Here’s how:

📈 Scalability Without the Overhead

You can easily scale operations up or down without the need to hire and fire, thanks to outsourcing. Whether you’re onboarding hundreds of new clients or dealing with seasonal peaks, third-party teams can soak up the volume — no HR hangar required. This flexibility allows you to plan your growth without a long-term commitment, whilst affording you the agility to respond to market needs quickly and cost-effectively.

⏳ Enable Quicker Processing and Response Times

Specialized teams are dedicated entirely to administrative workflows. The focus minimizes lags, improves processing, and fast-tracks responses — all of which contribute to an overall faster turnaround time. Clients experience faster service delivery, and your team is spared burnout. Quick response times also increase satisfaction among policyholders, providing a competitive edge in a packed insurance industry.

🔍 Higher Precision and Regulatory Compliance

Insurance VAs or back office teams know how to maintain documentation standards, policy language, and regulatory requirements. This minimizes the risk of mistakes, oversights, and non-compliance. By making sure that you’re strictly following industry rules as you set processes in your business, you’ll steer clear of expensive fines or customer disputes, while also looking forward to your work, knowing your operations are being done consistently and correctly.

💼 Increases Time for Core Functions

By externalizing repetitive administrative work, your internal personnel can add even more hours to underwriting, sales, client service, and biz dev — activities that generate revenue and retain clients. This transition improves both productivity and morale, empowering your team to concentrate on high-impact tasks that bolster strategic growth and enhance client satisfaction.

💰 Lower Operational Costs

This is usually a much more affordable way than keeping a complete in-house team. You are paying for deliverables, not for sitting idle hours — this allows you better control over expenses without compromising on output. This means a sleeker cost structure and better margins, with less friction to reinvestment in acquiring clients, tools, or talent.

📄 Policy Administration

Jobs such as creating, issuing, and renewing policies demand accuracy. In such cases, outsourcing teams can take over this complete workflow and make sure the marking, revision, and delivery to clients, where they need to get delivered, gets done without any errors and promptly. They can also manage endorsements, cancellations, and policy updates, minimizing manual mistakes while keeping policyholders up-to-date and reassured about their coverage.

💼 Claims Processing

From gathering documents to following up with insurers, outsourced support helps to accelerate the claims process and maintain proper documentation for each step. This assistance decreases turnaround times, increases communication amongst all stakeholders, and generates a standardized process for policyholders, which ultimately promotes success and trust in your agency.

📊 Data Entry and CRM Updates

Maintaining client records and policy data up to date is crucial. You can outsource this process to ensure that you’re getting real-time accuracy, and it’ll free up your teams from time-sucking manual input. VAs can keep your databases clean, remove duplicate entries, and even monitor renewal dates—helping you keep your CRM an accurate source for marketing, service, or compliance purposes.

📥 Email and Documents Management

Sorting, categorizing, and responding to routine emails can take hours. A virtual assistant helps triage all communications and keep all documents properly stored and compliant. They can work on email templates, create shared drives, and make sure important messages are never forgotten, streamlining collaboration and client communications.

🧾 Billing & Commission Tracking

Invoice Preparation: You can outsource to manage payment tracking and commission statements, keeping your money and financials transparent and up to date. VAs can resolve inconsistencies, send reminders, and ensure ledgers remain accurate — all of which will minimize the potential for disputes while keeping both the clients and agents advised of their current financial position.

📋 Underwriting Support

Virtual teams in these situations can help underwriters by collecting necessary documents, verifying their credibility, and preparing summaries, thus speeding up the approval process. They can also pre-qualify applications, enter risk data into underwriting systems, and follow up with agents or clients. That speeds up policy decisions and enables underwriters to concentrate their efforts on priority cases.

Also Read: Virtual Assistant Services in Newton

List of Back Office Tasks to Outsource in Insurance

Outsourcing back-office work doesn’t mean losing control—it means working smarter.

Here are the most frequently outsourced tasks that can matter:

📄 Policy Administration

Generating, providing out, and renewing policies are precision executions. Outsourced teams can handle this entire workflow and ensure timely and accurate delivery to clients.

💼 Claims Processing

From gathering documentation, going back and forth with insurers, and more, outsourced support can fast-track these claims to resolution and make sure both parties have their ducks in a row.

📊 Data Entry and CRM Updates

Maintaining updated client records and policy data is a must. By outsourcing this process, you increase accuracy in real-time while giving your team back the precious hours they were spending inputting data manually.

📥 Email & Document Management

Sorting, categorizing, and responding to routine emails can take hours. A virtual assistant can also triage communications and ensure documents are stored properly and compliantly.

🧾 Invoicing and Commission Tracking

The invoicing preparation, payment tracking, and commission statements are some more tasks that outsourcing solves, keeping your finances clear and updated.

📋 Underwriting Support

Virtual teams can help underwriters gather the required documents, verify the provided information, and prepare summaries, helping speed up the approval process.

Where Virtual Assistants Fit in The Insurance Process

Back office outsourcing is well-suited to virtual assistants (VAs). They offer agility, speed, and diverse skills specific to the insurance industry. Whether you are a small agency owner or a growing brokerage, VAs seamlessly fit into your existing workflow, relieving your team of repetitive, labor-intensive chores.

Here are some ways they improve your workflow:

1. Provide cross-time zone operation for 24/7 support:

This strategy helps reduce average processing time and underlines efficiency, even across time zones, which can be helpful for time-sensitive claims or document processing.

2. Leverage your current systems (AMS, CRM, documentation tools):

VAs trained in working on applications such as Applied Epic, EZLynx, Salesforce, and others do not shake up your systems. Effortless connection between agents, clients, and underwriters without upsetting your chain of command. They operate in the background, escalate issues only when necessary, and keep everyone in the loop.

3. Provide scalable support:

Scale up or down, adding more VAs as operations dictate. As a business grows, more virtual assistants can be onboarded when the workload requires it, providing scalability without the commitment of traditional hiring.

With appropriate training and SOPs established, a VA becomes an invaluable arm of your internal team, supporting cost-effectiveness and efficiency while your in-house staff focuses on client growth and retention.

Choosing the Right Back Office Partner

The Back Office Outsourcing provider is not a one-size-fits-all. Choosing the right partner could mean the difference between smooth growth and operational delays. Find a provider who understands the insurance industry and can fit into your workflow and compliance.

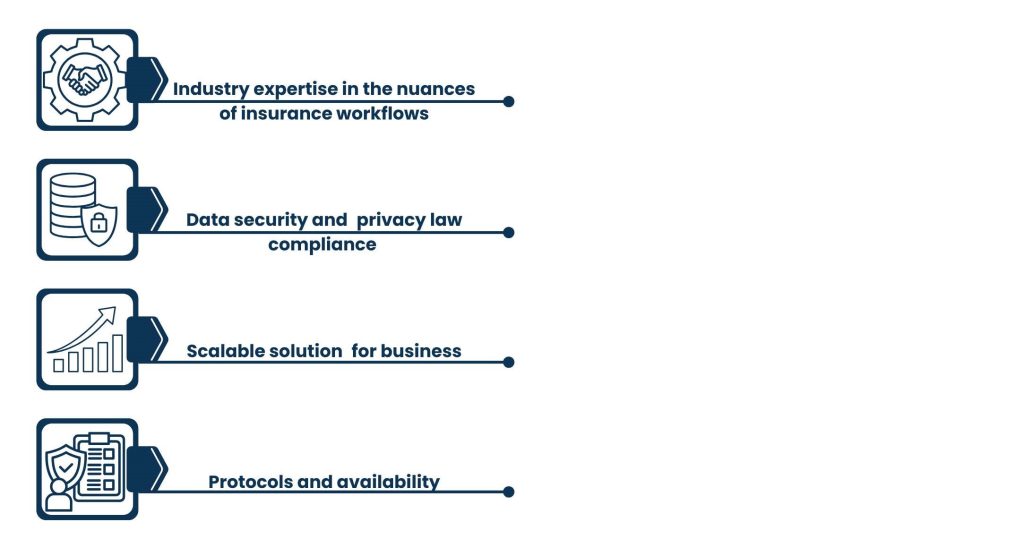

Consider these key factors:

- Industry expertise in the nuances of insurance workflows: They need to speak the language of policy terms, underwriting, claims, and agency management systems.

- Data security and privacy law compliance: Make sure they maintain stringent security protocols and understand HIPAA, GLBA, or state-specific rules.

- Scalable solution for business: Your outsourcing partner must grow alongside you, offering flexibility during seasonably surges or expansion phases.

- Protocols and availability: Customization and flexibility of services offered – A robust partner can mold their services to align with your precise operational model and platforms.

These pain points can be the difference between slinging untethered vendor work and acting as an extension of your agency with a quality partner. They will pay dividends over time by streamlining workflow, lowering your employee overhead, and providing a space that reflects your dedication to superior client service.

Conclusion

As the insurance industry continues to shift towards a more competitive and fast-paced environment, agencies looking for growth must keep their eyes on more than just sales—agency operational efficiency should also take center stage. Outsourcing insurance back-office services is a scalable solution that you can rely on without stressing your internal teams.

From policy processing and claims support to virtual assistants and outsourcing partners, the admin burden can be taken off your hands, allowing your team to do what they do best: build relationships, service clients, and grow your book of business.

With dedicated back-office support for insurance companies, we at Tasks Expert help insurance firms maximize their productivity. Whether it’s a VA to support policy admin or a full team handling claims processing, we have secure outsourcing designed for your growth objectives.

About Us

Tasks Expert offers top-tier virtual assistant services from highly skilled professionals based in India. Our VAs handle a wide range of tasks, from part time personal assistant to specialized services like remote it support services, professional bookkeeping service etc. Furthermore, it helps businesses worldwide streamline operations and boost productivity.

Ready to elevate your business? Book a Call and let Tasks Expert take care of the rest.