Introduction

Fintech software engineers are prominent in a financial revolution, changing how people access and use services. As consumers look for seamless, digital-first solutions, traditional financial models are giving way to embedded finance. This incorporates payments, lending, and insurance right into the apps and platforms we already use. Individuals are suddenly interacting with finance without even realising it, from scheduling rides to purchasing online.

Fintech software engineers create APIs, ensure regulatory compliance, and secure data transmission to power these frictionless transactions. They are mainly the architects of innovation rather than just backend engineers, allowing firms to provide banking-like services without becoming financial institutions.

Fintech developers are becoming increasingly important to product teams across industries as embedded finance gains popularity. Through their efforts, businesses are able to provide financial services with confidence, create new revenue sources, and enhance the user experience. Furthermore, they are building the future of financial access and inclusion rather than only producing tools.

What is Embedded Finance?

The embedding of financial services, such as lending, payments, insurance, and investment products, into non-financial digital platforms is referred to as embedded finance. Customers easily perform financial tasks within the service they are currently consuming, as opposed to directing them towards third-party apps.

For example:

- Ride-hailing apps that offer real-time insurance options at checkout.

- E-commerce platforms that let users pay in installments through Buy Now, Pay Later solutions.

- SaaS platforms that provide embedded invoicing and payment collection tools.

This evolution puts financial services directly in front of users, making transactions faster, easier, and more intuitive.

But the shift to embedded finance isn’t just about convenience. It demands:

- Robust backend infrastructure to handle high transaction volumes.

- Real-time processing to keep up with user expectations.

- Regulatory compliance to meet global financial laws.

- Bank-grade security to protect sensitive data.

Skilled fintech software developers are at the heart of this shift. They build APIs, design compliance frameworks, and manage the secure flow of data between systems, enabling companies to deliver banking-grade features without having to become financial institutions themselves. In short, they are making finance invisible, accessible, and embedded into our digital lives.

Also Read: Virtual Assistant Services in Doha

The Role of Fintech Software Developers

Fintech software developers are more than just coders; they are the strategic enablers behind the embedded finance revolution. They serve as a link between a user-friendly, real-time interface and complex financial processes. These astute developers convert corporate objectives into technological infrastructure that is compliant, scalable, and safe.

Their Key responsibilities:

- Designing modular APIs for financial services that can be embedded into any platform. These APIs become the backbone of embedded payments. Allowing lending and insurance systems.

- Developers must comprehend compliance and include it in the system architecture. Adhering to laws such as PSD2 (Payment Services Directive), AML (Anti-Money Laundering), and KYC (Know Your Customer). To avoid regulatory concerns.

- Optimizing security, especially in sensitive areas like identity verification, data encryption, and secure user authentication. A single vulnerability could lead to reputational and financial disaster.

- Building scalable infrastructure to support high-volume financial transactions, manage microservices, and respond to user demands without performance degradation.

- Integrating with legacy banking systems while still enabling a smooth, modern UX. Fintech developers must translate old protocols into new experiences without compromising speed or security.

But their role doesn’t stop at implementation. Fintech software developers are deeply involved in:

- System monitoring and maintenance to ensure 24/7 uptime and real-time responsiveness.

- Testing and deployment pipelines that meet both fintech agility and high-assurance reliability.

- To align on requirements and outcomes, collaborating with cross-functional teams, including legal, product, and customer experience.

In embedded finance, time-to-market matters—but so does trust. Developers need to build fast and securely. Their ability to balance innovation with risk management is what separates average fintech products from exceptional ones.

By enabling startups, SaaS providers, e-commerce platforms, and even healthcare apps to “plug and play” financial services, fintech developers don’t just build code—they build entirely new business models. Their work leads to better user retention, higher revenue potential, and scalable growth.

Why the Demand for Fintech Software Developers Is Rising?

With the market predicted to reach $7 trillion during the next ten years, the embedded finance sector is on a path toward rapid expansion. The demand for highly qualified fintech software developers has never been higher as businesses from a variety of sectors, including retail and SaaS, scramble to include financial services into their platforms.

This demand isn’t driven by hype. Businesses embedding digital wallets, microloans, real-time payments, and insurance options into their user flows need developers who understand both the financial landscape and the technical challenges that come with it.

Organizations are now actively seeking:

- Cross-functional expertise in areas like compliance, user experience, and data security.

- Speed and agility to shorten development cycles and adapt to ever-changing regulations.

- Deep tech knowledge in API design, cloud-native architecture, blockchain, and fraud analytics.

The talent shortage is prompting fierce competition for fintech developers who can deliver secure, compliant, and scalable infrastructure. Those with experience in AI-driven decision models, decentralized finance (DeFi), and global payment networks are especially in demand.

In short, fintech software developers are no longer niche players—they’re essential architects in shaping the future of digital finance.

Industries Benefiting Most from Embedded Finance

Embedded finance is being adopted by diverse industries to add value and unlock new revenue streams. Businesses across sectors are weaving financial capabilities directly into their customer journeys with the expertise of fintech software developers.

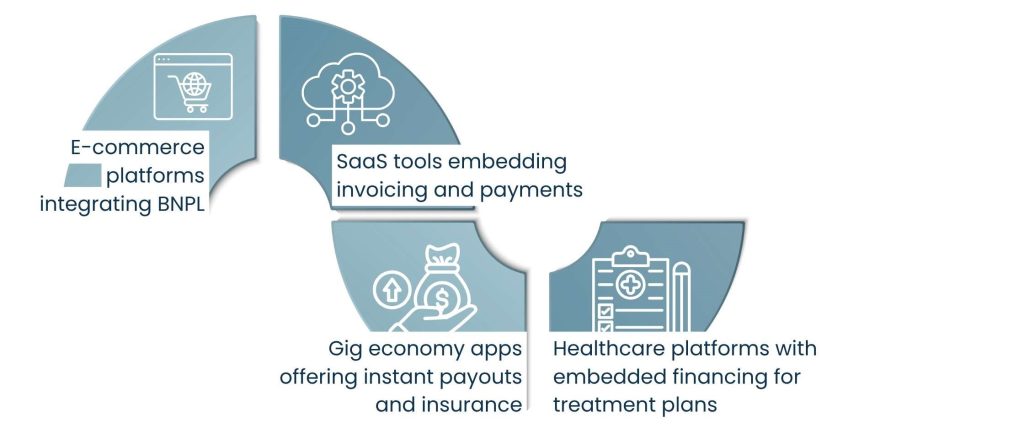

1. E-commerce platforms integrating BNPL (Buy Now, Pay Later):

Major retailers now offer installment payments through embedded APIs, boosting conversions and reducing cart abandonment. Developers integrate these services seamlessly at checkout.

2. SaaS tools embedding invoicing and payments:

Business software platforms now allow users to send invoices, accept payments, and manage cash flow—all without leaving the app. Fintech developers build secure, compliant modules that make this possible.

3. Gig economy apps offering instant payouts and insurance:

Platforms like ridesharing and delivery services embed micro-financial services such as earnings advances and gig insurance. This improves worker retention and platform loyalty.

4. Healthcare platforms with embedded financing for treatment plans:

Fintech developers help build features that allow patients to access loans or payment plans directly during online booking or billing, increasing access to care.

These use cases show how embedded finance adds functionality and builds trust when built right by skilled fintech software developers.

Key Technologies Used by Fintech Software Developers

To power embedded finance effectively, fintech software developers rely on a mix of modern and emerging technologies. These tools ensure their solutions are secure, scalable, and interoperable across platforms and regions.

1. API-first development frameworks:

Fintech platforms nowadays are modular and designed to operate on various platforms. To ensure smooth connectivity, developers employ RESTful APIs, GraphQL, and OpenAPI specs.

2. Cloud infrastructure and containerization:

Through Azure, AWS, Docker, and Kubernetes, the developers are able to build scalable apps for handling sensitive financial data, bursts of payments, and real-time payments.

3. Smart contracts and blockchain:

When developing fintech solutions for secured ledgers, cross-border payments, or decentralized finance (DeFi), blockchain technologies such as Ethereum, Solana, and Hyperledger offer trust and transparency.

4. AI/ML for credit scoring and fraud detection:

Machine learning algorithms are trained to identify user activity patterns and make decisions such as credit approvals, loan underwriting, and risk profiling.

5. Open banking protocols:

Standards such as PSD2, FDX, and Open Finance APIs are used by developers to securely access the customer’s financial information and provide personalized experiences in banking apps, marketplaces, and service platforms.

These technologies are the technological infrastructure behind embedded finance platforms of today, and it is the fintech software developers who are conducting them.

Also Read: Virtual Assistant Services in Mesaieed

Future of Embedded Finance

The future of embedded finance is being scripted in real time, and the writers are fintech software developers. As financial infrastructure becomes more modular and data-driven, developers will shape the next generation of experiences by building platforms that are smarter, more personalized, and globally interoperable.

Several technology trends are converging in this transformation:

1. Artificial Intelligence (AI):

Developers are using AI to automate financial decision-making. Such as real-time credit scoring and fraud detection. AI-powered financial tools will become increasingly accurate and autonomous.

2. Open Banking:

Regulatory initiatives and APIs are opening access to user financial data. Developers will be tasked with building applications that securely leverage this data to offer personalized products, budgeting tools, and lending insights.

3. Decentralized Finance (DeFi):

With increasing interest from mainstream platforms, developers are integrating blockchain-based DeFi services such as tokenized assets and smart contract-based lending into user interfaces.

4. Real-Time Underwriting:

Data-driven infrastructure allows developers to enable financial providers to evaluate risk and offer financial products in seconds, not days, by integrating real-time data flows and AI models.

5. Hyper-personalization:

The future will also feature embedded financial services that respond dynamically to user behavior, location, transaction history, and preferences, giving rise to entirely unique user journeys.

6. Cross-border functionality:

Developers will build embedded finance products that handle multicurrency transactions, global compliance, and localized user experiences, simplifying international commerce.

Looking ahead, fintech software developers will be integral to turning financial services into intuitive, ambient features woven into the digital environments people already use. Their role will grow beyond implementation to become innovation leaders advising on product strategy, ethical AI usage, and financial inclusivity.

The platforms that succeed in the next wave will be those that treat fintech development not as an IT function but as a core strategic advantage.

Conclusion

The rise of embedded finance is not a passing trend—it’s rapidly becoming the new operating system for the digital economy. From e-commerce platforms to SaaS tools and gig economy apps, embedded financial services are now core features rather than optional add-ons.

At the heart of this transformation are fintech software developers—the engineers, strategists, and innovators building the infrastructure that enables it all. These professionals don’t just implement code; they design scalable, compliant, and secure systems that power next-gen financial experiences.

Their ability to balance innovation with regulation and user experience makes them vital to companies aiming to add financial tools directly within their digital products. As user expectations grow and the demand for frictionless finance accelerates, businesses that rely on skilled developers to embed finance meaningfully and responsibly will stand out.

Fintech developers aren’t behind the scenes—they’re out front, driving the shift. Hiring fintech software developers is not just smart—it’s essential for long-term relevance and competitive advantage for any company entering or scaling in the embedded finance space.

About Us

Tasks Expert offers top-tier virtual assistant services from highly skilled professionals based in India. Our VAs handle a wide range of tasks, from part time personal assistant to specialized services like remote it support services, professional bookkeeping service etc. Furthermore, it helps businesses worldwide streamline operations and boost productivity.

Ready to elevate your business? Book a Call and let Tasks Expert take care of the rest.