Introduction

Accurate finance management is an important factor for a business. However, small and medium-sized companies find in-house bookkeeping resource-intensive. Outsourcing accounting services is the best solution as they provide professional advice for business finances at lower costs, free up resources, and help concentrate on growth.

This blog describes the benefits of accounting services outsourcing, the types of work they do, and how to select a good provider for your business.

Define Outsourcing Accounting Services

Hiring external professionals to handle bookkeeping and tax preparation is outsourcing accounting services. The service provider has the experience and tools to perform tasks accurately.

Key tasks:

- Bookkeeping and data entry

- Payroll processing

- Tax preparation and compliance

- Analysis and reporting

- Forecasting

- Budgeting

Outsourcing helps businesses enjoy world-class accounting without an in-house accounting team.

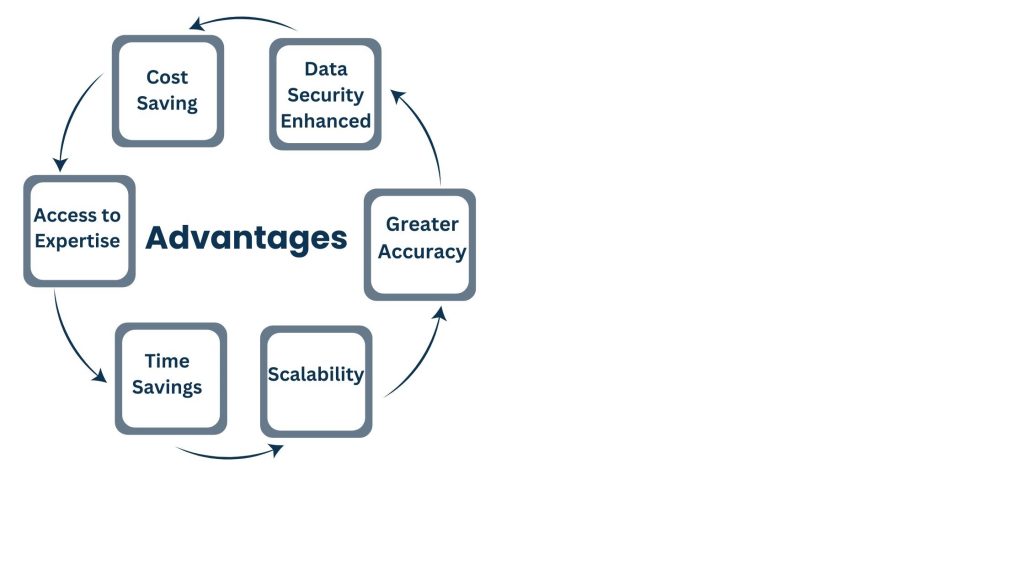

Advantages

Outsourcing accounting services offers numerous advantages that go beyond cost savings.

Here’s why more businesses are opting for this approach:

- Cost Saving

- Saves the cost of employing, training, and maintaining an in-house team.

- Saves costs on accounting software and infrastructure.

- Access to Expertise

- Provides access to experienced professionals specialized in accounting and compliance services.

- Help you remain updated with tax laws, financial regulatory policies, and trends.

- Time Savings

- Have extra time to handle core business operations.

- Save the headache of undertaking routine financial operations.

- Scalability

- Scale accounting services up or down based on your needs.

- Handle peak seasons without recruiting seasonal staff.

- Greater Accuracy

- Avoid errors in accounts through the intervention of professionals.

- Decrease the chance of penalties and audits for not adhering to regulations.

- Data Security Enhanced

- Service providers use futuristic data security measures, particularly when dealing with confidential financial information.

Outsourcing saves companies more money and fewer headaches with reliability and accuracy.

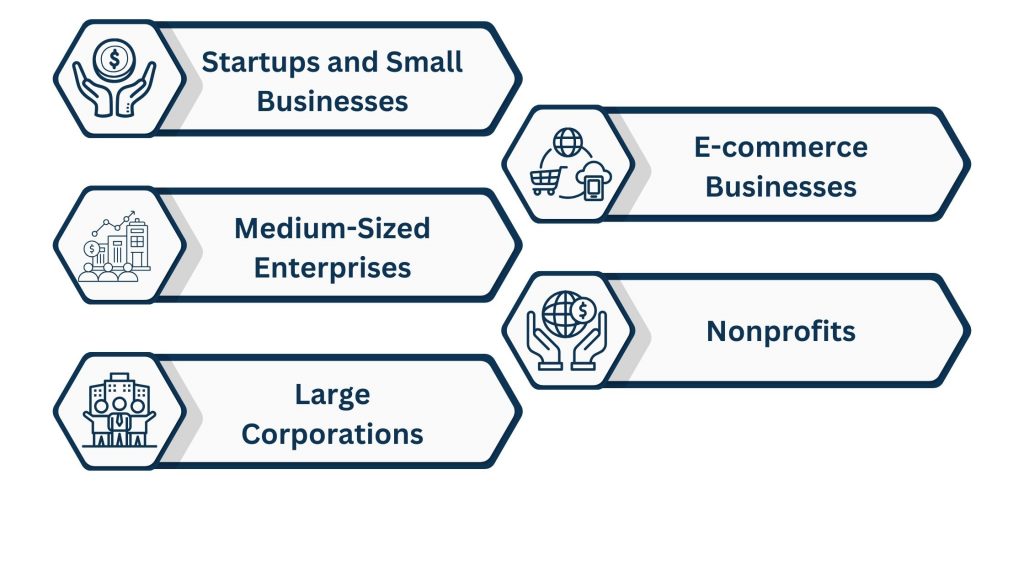

Businesses That Should Outsource Accounting Services

Numerous businesses can take advantage of outsourcing. Some of them are:

- Startups and Small Businesses: Outsourcing is the best remedy for companies with fewer resources and high demands.

- Medium-Sized Enterprises: External professionals handle financial tasks and internal teams can focus on growing the business.

- Large Corporations: They can pass routine tasks to experts and have internal teams handle strategic initiatives.

- E-commerce Businesses: Successfully manage complex transactions, stock, and tax compliance.

- Nonprofits: Outsourcing is an easy option that is accurate and compliant with non-profit accounting standards.

Key Business Functions to Delegate for Maximum Efficiency

Most financial activities businesses carry out while outsourcing include:

- Bookkeeping

- Maintain records with accuracy and flawlessly.

- Monitors income, expenses, and cash flow.

- Tax Preparation

- Preparation and filing of tax returns based on the laws that prevail in national and international sectors.

- Identification of tax savings and reduction.

- Payroll Management

- The processing of salaries, deductions, and other benefits to the employees.

- Observing labor law and tax law.

- Reporting

- Prepare profit and loss statements, and cash flow reports.

- Insights to help with informed decisions.

- Budgeting and Forecasting

- Financial plans to aid business growth.

- Analysis of trends and opportunities.

- Accounts Payable and Receivable

- Payment to vendors and collection from customers.

- Monitoring and collection of overdue accounts.

Accuracy, compliance, and efficiency in financial management are ensured by outsourcing such services.

Choose the Best Accounting Service Provider

The right partner is important for maximizing the benefits of outsourcing accounting services.

Here are some tips:

- Evaluate Experience and Expertise

- Providers with a strong track record in your industry.

- They are certified and up-to-date on the latest accounting standards.

- Evaluate Technology and Tools

- Whether the service provider utilizes modernized accounting software for accurate and up-to-date information.

- If they can work with your systems.

- Prioritize Data Security

- Whether the supplier has appropriate security measures against confidential information.

- Ensure the supplier adheres to the set data protection standards.

- Assess Customization

- Select a provider that offers customized services according to the requirements of your business.

- Evaluate Testimonials and References

- Review client testimonials and success stories to gain insights into the reliability and performance of your selected supplier.

With these options, businesses can be well-assured of smooth financial management and prolonged survival.

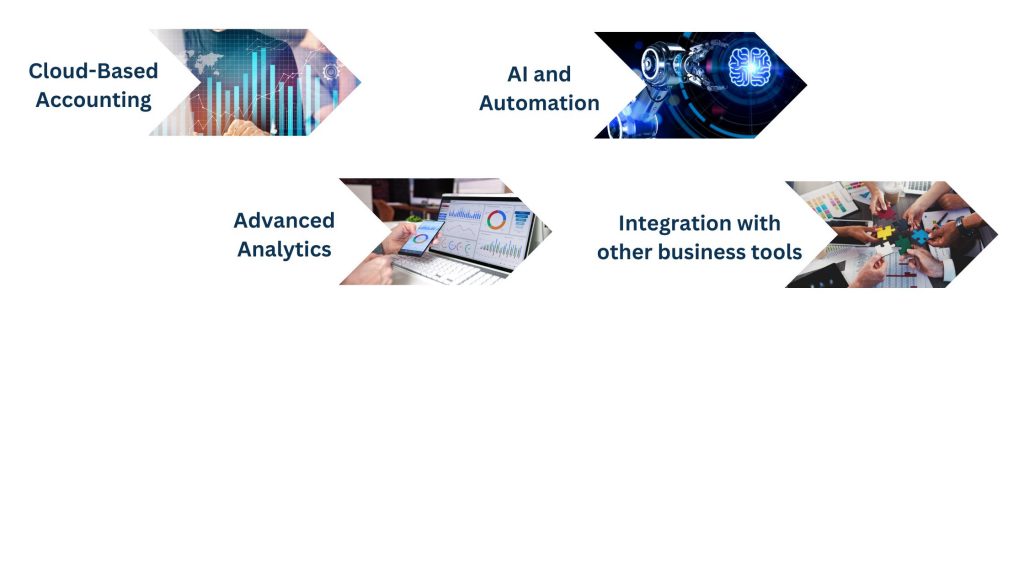

The Future of Outsourced Accounting Services

Outsourcing accounting services will become more efficient and accessible with technology.

Here are some trends shaping the future:

- Cloud-Based Accounting: Instant access to financial data from any corner of the world.

- AI and Automation: Automate time-consuming data input and invoice processing tasks to reduce errors.

- Advanced Analytics: Data-driven insights for strategic decisions.

- Integration with other business tools: Seamless integration into CRM, HR, and project management software.

This way, companies can take advantage of the new opportunities for efficiency and growth.

Conclusion

Outsourcing accounting services is a game changer that effectively manages finances, reduces costs, and provides professional minds to enhance performance. On outsourcing, whether startups or large-scale business entities, the business has ample focus on core activity.

Get ready to streamline your finances. Partner with Tasks Expert for a trusted accounting service provider and enjoy the fruits of professional financial management today.

About Us

Tasks Expert offers top-tier virtual assistant services from highly skilled professionals based in India. Our VAs handle a wide range of tasks, from part time personal assistant to specialized services like remote it support services, professional bookkeeping service etc. Furthermore, it helps businesses worldwide streamline operations and boost productivity.

Ready to elevate your business? Book a Call and let Tasks Expert take care of the rest.