Introduction

Tax season is the most shocking month for many people and businesses. Due to changing regulations, complicated compliance requirements, and the necessity of correct reporting, navigation through tax landscapes in Melbourne seems impossible. This is where a professional tax accountant in Melbourne helps manage your finances and meet deadlines.

Today, we will discuss the tax accountant role in Melbourne, its advantages, and how to choose the right one for you.

Understand Tax Accountant

A tax accountant is a financial expert who handles tax preparation, and compliance. They help people and businesses reduce tax liabilities by proper reporting.

Key duties of a tax accountant:

- Prepare and lodge individual, company, and sole trader income tax returns.

- Engage in discussions on tax relief credits and concessions.

- Development of tax avoidance and minimization.

- Tax consultancy.

- Adherence to Australian Taxation Office regulations.

- Managing GST, BAS, PAYG control for businesses.

- Represent a client in audit cases or Australian Taxation Office disputes.

Why Choose Melbourne's Tax Accountant?

Melbourne is indeed an exciting city, alive with business and economic activities in diverse things. A Melbourne tax accountant knows the local financial regulations and can tailor a plan to your situation.

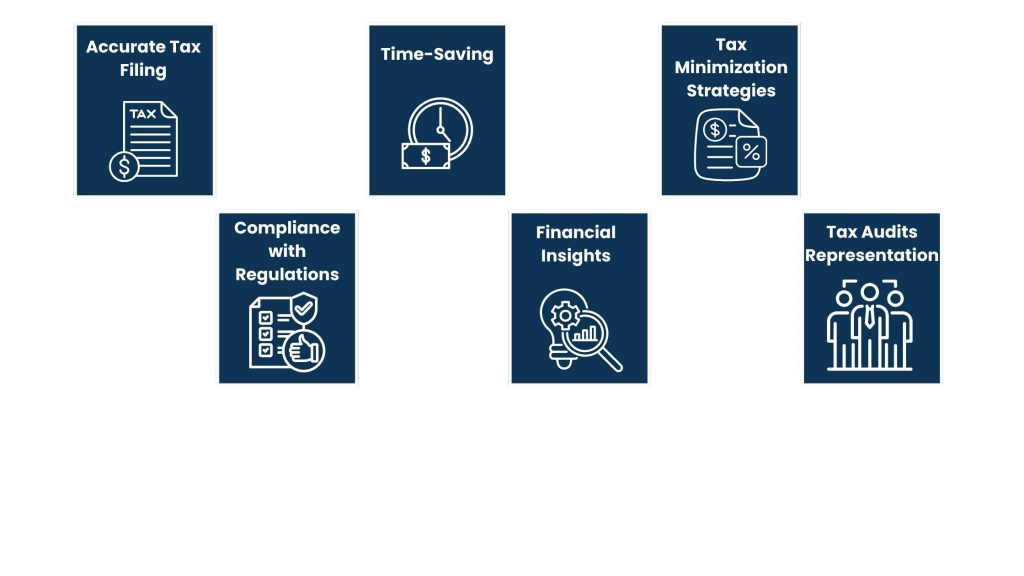

Key benefits of a tax accountant in melbourne:

1. Accurate Tax Filing

- Avoid errors that could result in penalties or audits.

- Ensure all deductions and credits are claimed correctly.

2. Time-Saving

- Free up time to focus on personal or business priorities while your accountant handles complex tax calculations and submissions.

3. Tax Minimization Strategies

- Get expert advice on reducing tax liabilities with legitimate methods, like optimizing deductions and structuring finances.

- Get expert advice on reducing tax liabilities with legitimate methods, like optimizing deductions and structuring finances.

4. Compliance with Regulations

- Be updated about the current ATO rules and requirements to avoid legal misunderstandings.

5. Financial Insights

- Valuable insights into financial performance and areas of improvement.

6. Tax Audits Representation

- Be represented by a professional during tax audits or any dispute arising, ensuring smooth and effective resolution.

Who Needs the Service of a Tax Accountant in Melbourne?

1. Individuals

- All professionals and freelancers earn through multiple income sources.

- Any owner of a property managing the income and deductibles from rent.

- Those with high incomes would want tax optimization strategies.

2. Small Businesses

- Single and family businesses, partnerships. Companies seeking effective management of GST, BAS, and PAYG.

3. Companies

- Large businesses with complex accounting, payroll management, and corporate tax preparation.

4. Start-ups

- Entrepreneurs who want advice on how to structure their business to minimize taxation but remain compliant from the beginning.

5. Expats

- Foreign nationals working in Melbourne who help with Australian taxation are needed.

Choose an Appropriate Tax Accountant in Melbourne

Choosing the best tax accountant in Melbourne is a challenging task.

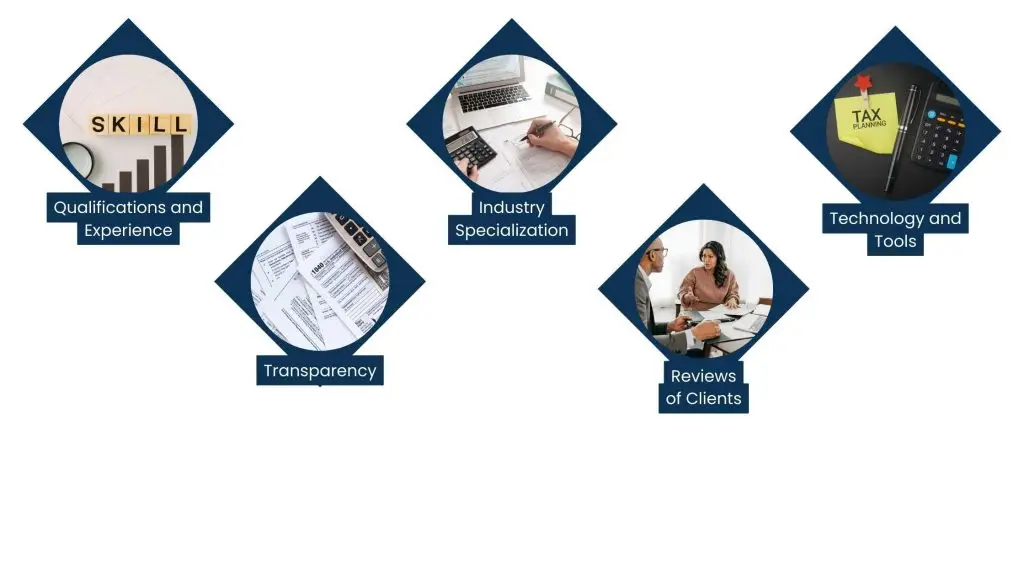

Consider the following:

1. Qualifications and Experience

- Ensure the accountant is a registered tax agent with the Tax Practitioners Board (TPB).

- Consider the accountant’s experience in areas relevant to your needs, such as individual tax or corporate accounting.

2. Industry Specialization

- Choose an accountant, familiar with your industry to leverage their knowledge of relevant tax laws.

3. Technology and Tools

- Choose accountants who utilize modern software to ensure efficient and accurate reporting.

4. Transparency

- Seek transparent pricing and communication for surprise costs.

5. Reviews of Clients

- Check feedback or recommendations to estimate the reputation and credibility of the accountant.

How to Ensure a Successful Collaboration with Your Tax Accountant

The most effective way to benefit from an accountant for taxes is by implementing these tips:

- Be an Organizer: Organize your financial records, bills, and other documents to make the process easier.

- Communicate Effectively: Communicate your financial goals and issues to your accountant to better tailor solutions.

- Plan Ahead: Involve your tax accountant in planning well before the beginning of the financial year to anticipate tax plans.

- Review Periodically: Set review periods to check your financial health and track your set goals.

Future of Tax Accounting in Melbourne

With advancements in technology, tax accounting has become efficient and accessible.

Here are the trends shaping the future:

- Cloud-Based Accounting: It helps streamline data storage and access for easy collaboration between the client and the accountant.

- Automation and AI: It automates repetitive tasks like data entry and tax calculation to save time and reduce errors.

- Digital Tax Lodgment: Streamlines the submission process through online platforms and government portals.

- Personalized Financial Insights: Use advanced analytics to deliver personalized recommendations to spur financial growth.

Conclusion

Hiring a tax accountant in Melbourne is an investment toward financial peace. As an individual, small business owner, or large corporation, their expertise ensures accurate tax filing, compliance, and optimized financial strategies. Working with the right professional can give you peace of mind about concentrating on your goals while leaving the complexities of taxation to capable hands.

Get ready to simplify your tax process. Contact Tasks Expert to engage a trusted tax accountant in Melbourne today and experience stress-free financial management.

About Us

Tasks Expert offers top-tier virtual assistant services from highly skilled professionals based in India. Our VAs handle a wide range of tasks, from part time personal assistant to specialized services like remote it support services, professional bookkeeping service etc. Furthermore, it helps businesses worldwide streamline operations and boost productivity.

Ready to elevate your business? Book a Call and let Tasks Expert take care of the rest.